Casual Conocophillips Financial Statements

The ConocoPhillips Annual Report archive and translation reports.

Conocophillips financial statements. 12312020Q4 9302020Q3 6302020Q2 3312020Q1 1231. Discounted Cash Flow DCF Valuation. Reports Resources Expand Navigation.

Analysis of Components of Financial Statements. Corporate Logos Standards. Analysis of Financial Ratios.

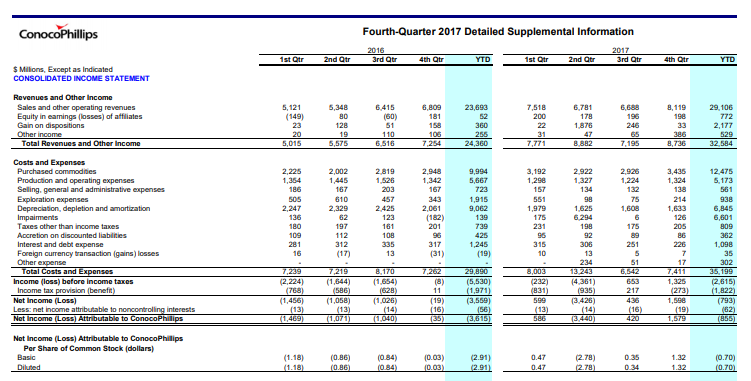

ConocoPhillips COP financial statements 2021 and earlier Company profile. Financial reporting quality relates to the accuracy with which ConocoPhillipss reported financial statements reflect its operating performance and to their usefulness for forecasting future cash flows. COP today reported a third-quarter 2020 loss of 05 billion or 042 per share compared with third-quarter 2019 earnings of 31 billion or 274 per share.

You can evaluate financial statements to find patterns among ConocoPhillips main balance sheet or income statement drivers such as Direct Expenses of 127 B Cost of Revenue of 177 B or Gross Profit of 62 B as well as many exotic indicators such as Interest Coverage of 1901 Long Term Debt. Macroaxis encourages investors to analyze financial statements over time for various trends across multiple indicators and accounts to determine whether ConocoPhillips is a good buy for the upcoming year. HOUSTON ConocoPhillips NYSE.

Economic Value Added EVA Long-term Trends. ConocoPhillips financial statements provide useful quarterly and yearly information to potential ConocoPhillips investors about the companys current and past financial position as well as its overall management performance and changes in financial position over time. Income statements balance sheets cash flow statements and key ratios.

Use fundamental data analysis to double-check all available reported financial drivers of ConocoPhillips to find out if markets are. ConocoPhillips Other companies not purchased previously Financial Statements. ConocoPhillips Investor presentations speeches and conferences.