Marvelous Accrued Liability For Utilities

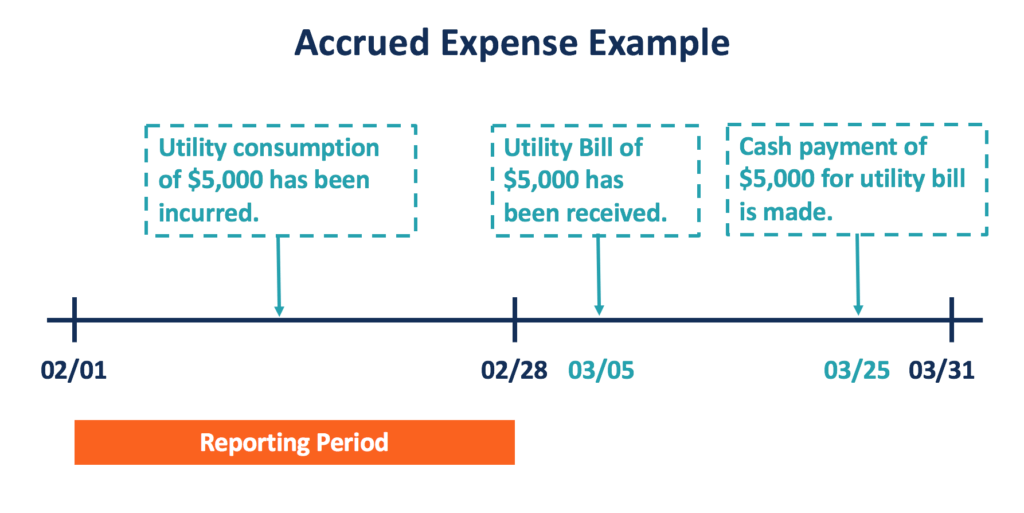

While such liabilities are recorded at the end of each accounting period and involve considerable estimation accounts payable normally record as the normal course of business based on proper invoices from suppliers.

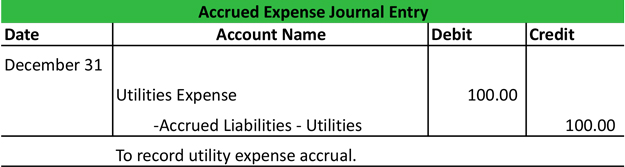

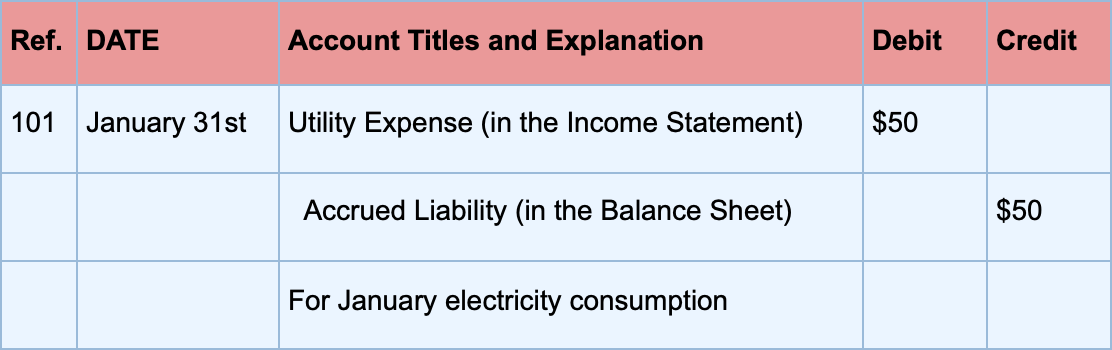

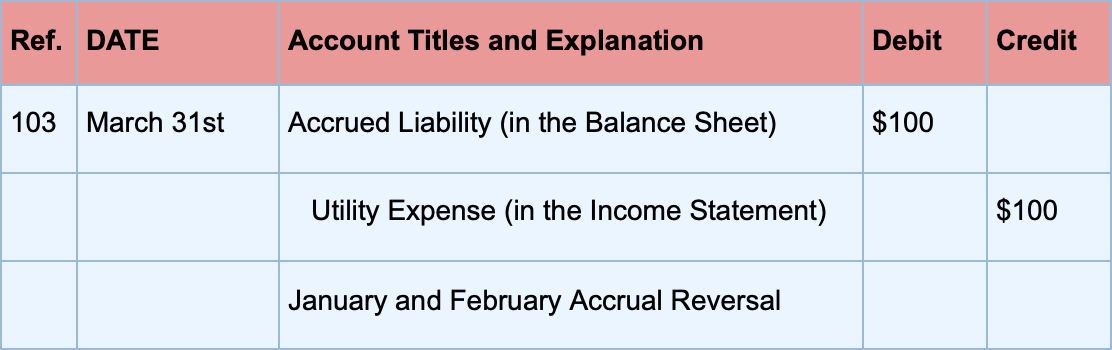

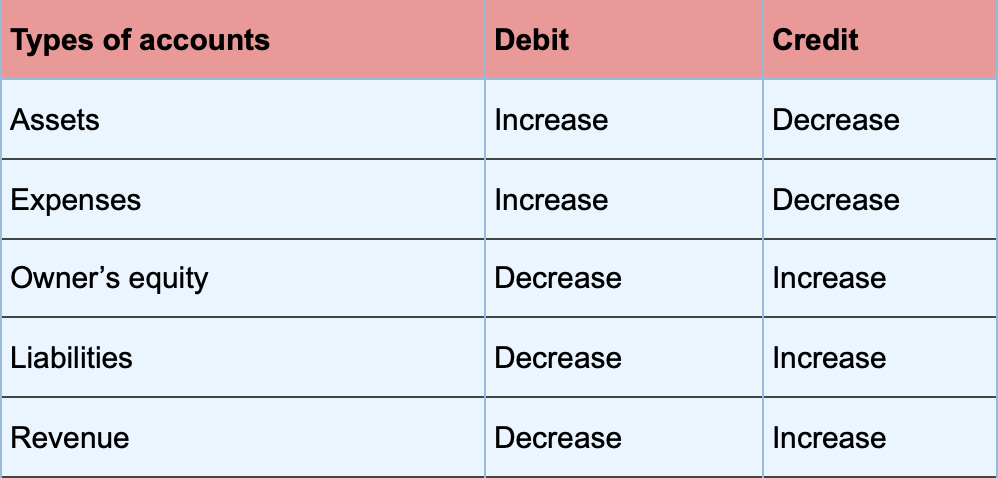

Accrued liability for utilities. You used utilities for your business but havent yet been billed. There is a tiny but important difference between accrued liabilities and accounts payable. Account 1 Account Type IncreaseDecrease DebitCredit Account.

The utility expenses for March correctly included the 20 days of expenses paid February-March bills plus the 11 days accrued at March 31. Accrued expenses also called accrued liabilities are payments that a company is obligated to pay in the future for which goods and services have already been delivered. Accrued liability occurs when the company incurs an expense but the same has not been billed and paid yet.

Account 1 Account Type IncreaseDecrease DebitCredit Account 2 Account Type IncreaseDecrease DebitCredit Paid Cash For Rent. Typical examples of accrued liabilities include. Accrual basis of accounting requires the expenses to be recorded when incurred regardless of their payment status.

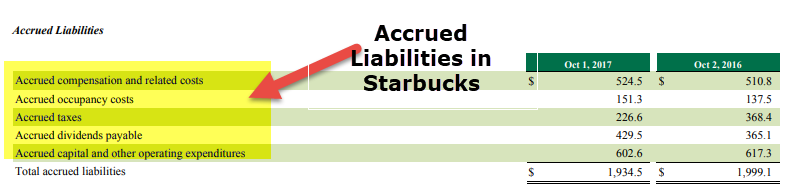

These types of expenses. Typical accrued expenses include utility salaries and goods and services consumed but not yet billed. The Division of Accounts will record the necessary June 30 accrued liability for the credit card processing fees related to June activity.

Accrues electricity and other utilities. Accrued interest on loans. An accrued liability represents an expense a business has incurred during a specific period but has yet to be billed for.

An accrued liability is the expense that is incurred by a business but not yet billed or paid. Utilities used for your business but the bill for the same not received. Utilities that your company has used but not yet paid for also count as accrued liabilities as do servicesgoods that youve received and used but havent been billed for.

:max_bytes(150000):strip_icc()/dotdash_Final_Liability_Definition_Aug_2020-01-5c53eb9b2a12410c92009f6525b70e7a.jpg)