Fun Statement Of Cash Flows Partial

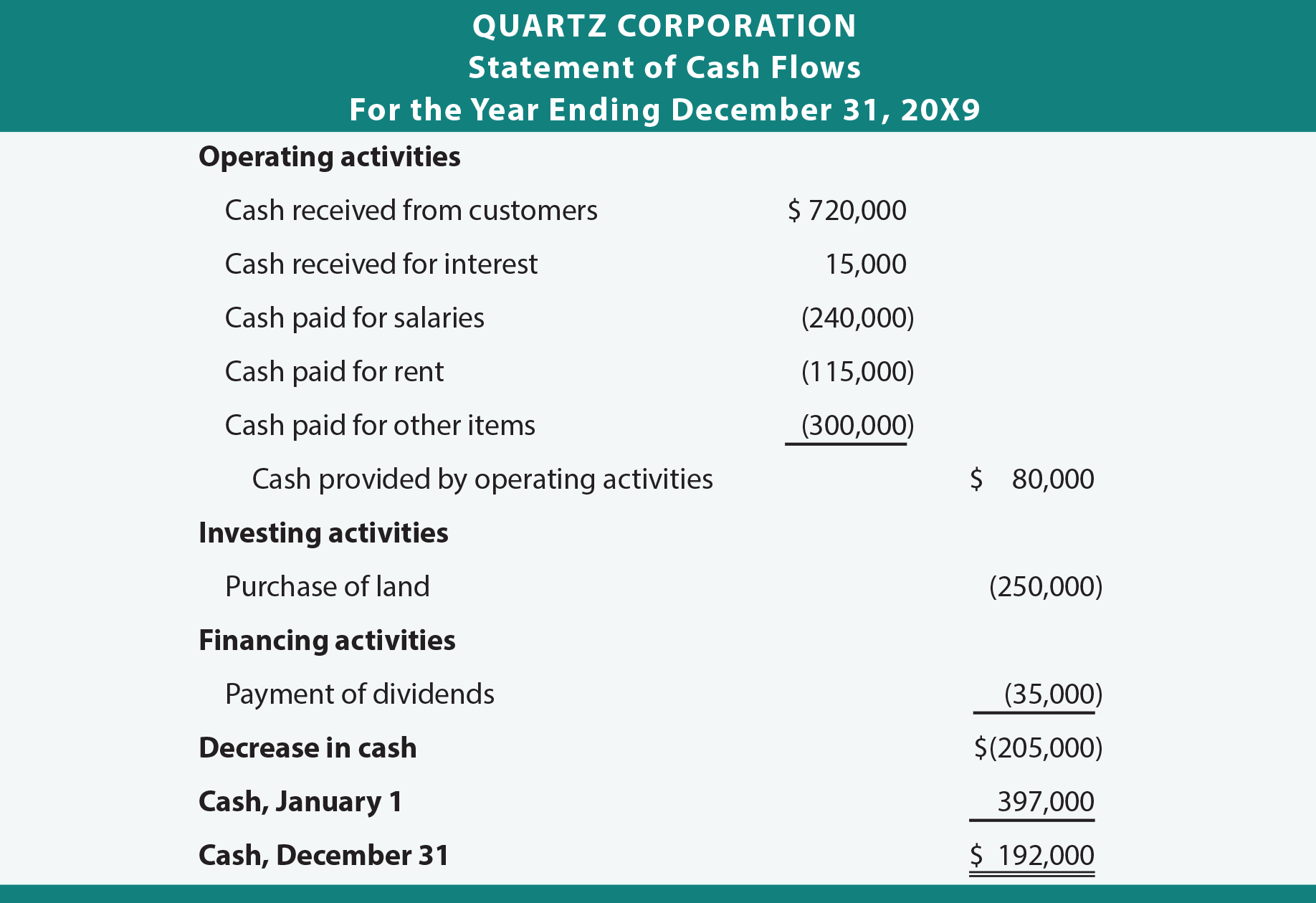

Consolidated statement of cash flows Direct method 1.

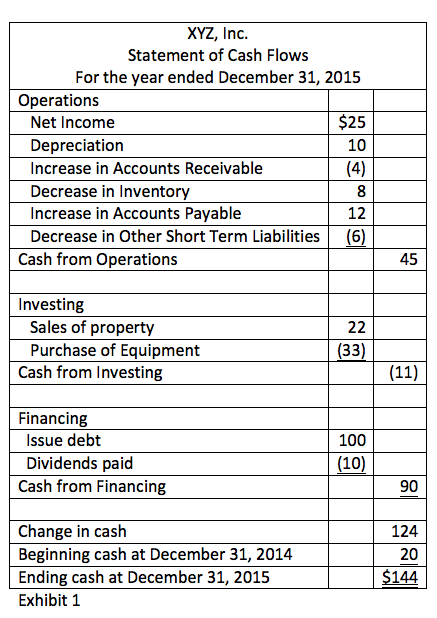

Statement of cash flows partial. Acquisition of subsidiaries During the financial year the fair values of net assets of subsidiaries acquired were as follows. There are two different ways of starting the cash flow statement as IAS 7 Statement of Cash Flows permits using either the direct or indirect method for operating activities. When the direct method is used the cash flows from operating activities shall be presented as follows.

Cash flows from Operating is 7000 Investing 217000 Financing 160000 which gives a net decrease in cash of 50000. 60000 Loss on disposal of equipment. The latter is illustrated in this publication.

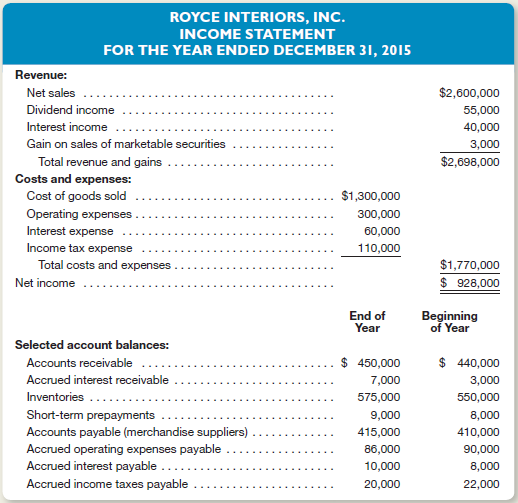

67000 Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense. As the loans made and collected including the interest are part of a governmental program the loan activities are reported as operating activities rather than investing activities. An entity can present its statement of cash flows using the direct or indirect method.

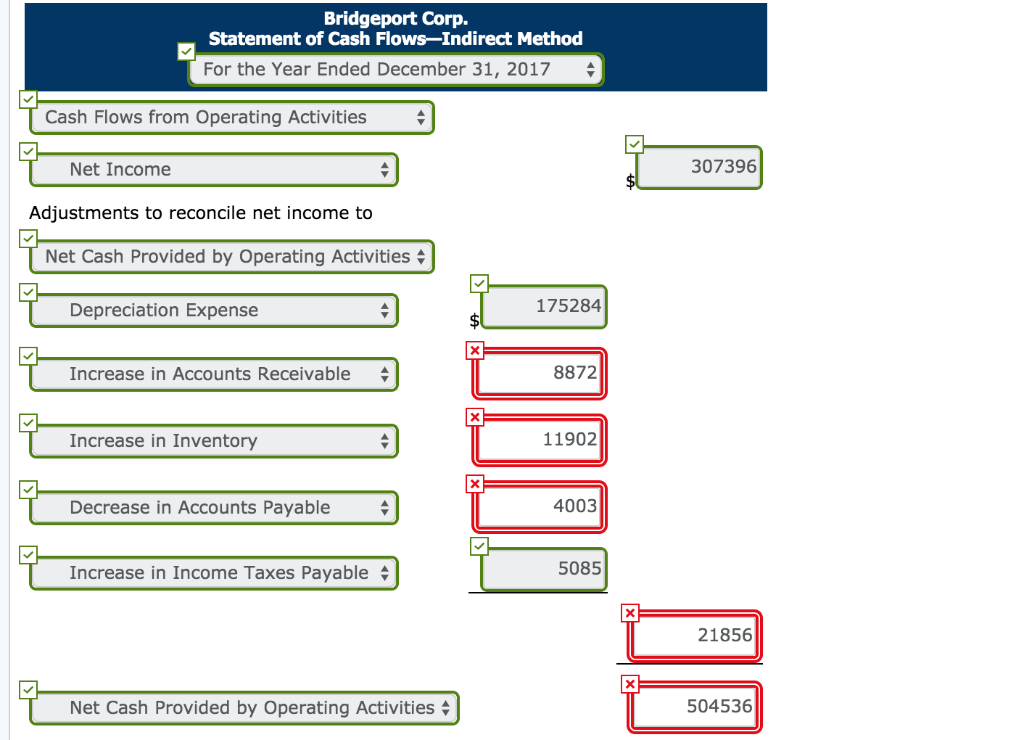

The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. A cash flow statement is a regular financial statement telling you how much cash you have on hand for a specific period. 230000 Adjustments to reconcile net income to net cash provided by operating activities Depreciation expense.

Consolidated Statement of Cash Flows See accompanying notes to the financial statements. 2011 2010 000 000 Cash flows from operating. 5000 33000 Net cash provided by operating activities.

Statement of Cash Flows partial Cash flows from operating activities 18500000 2 Net income Adjustments to reconcile net income to net cash flow from operating activities. 6 Decrease in accounts receivable 545000 7Decrease in prepaid expenses 90000 8 Increase in salaries. Notes to Consolidated Statement of Cash Flows A.