Neat Gaap For Non Profit Organizations

Different organizations have very different in-depth and specific accounting practices based on their particular structure and legal standing.

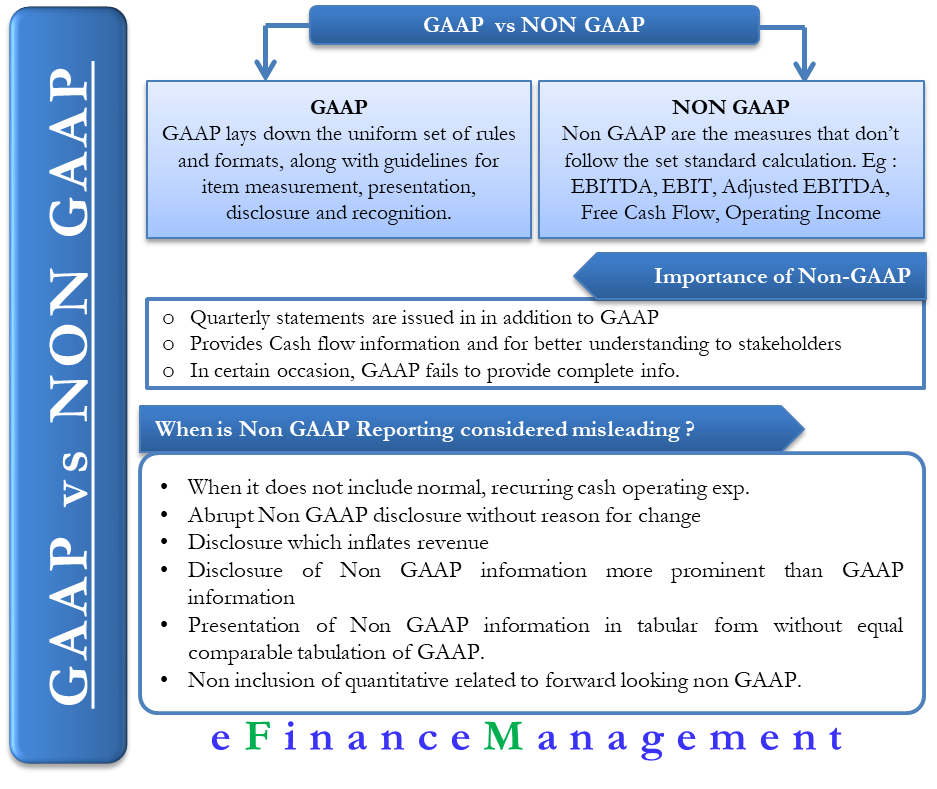

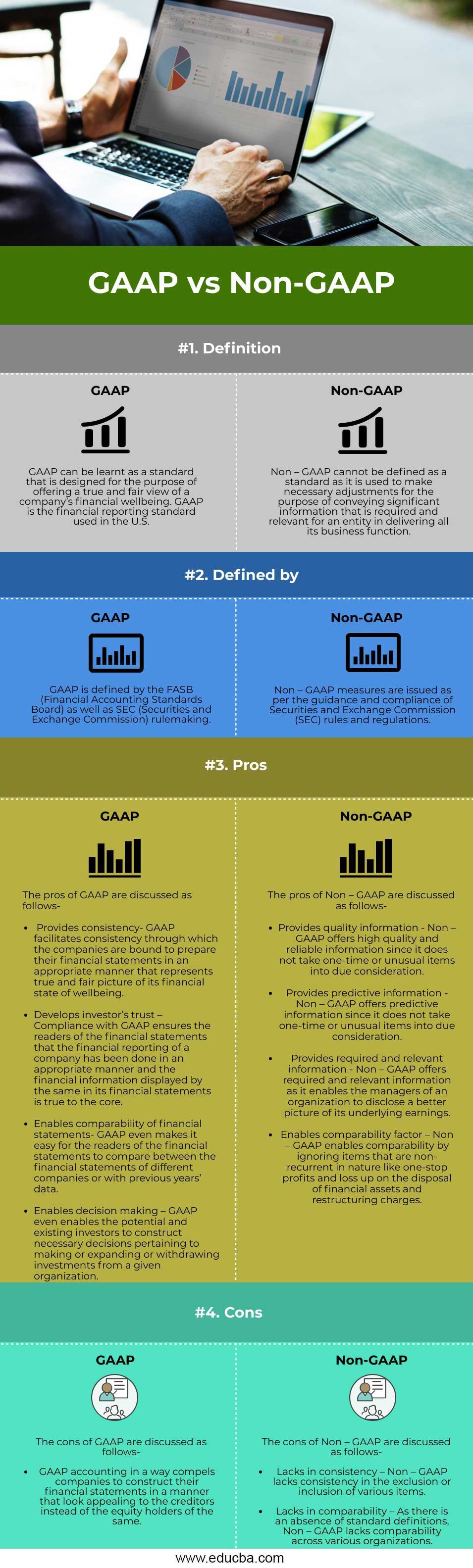

Gaap for non profit organizations. Statement of financial position. Last week the Financial Accounting Standards Board FASB the body authorized to promulgate generally accepted accounting principles GAAP in the US issued an Exposure Draft that if adopted would make significant changes to GAAP reporting in financial statements for nonprofit organizations. For example a government agency a bank and a non-profit foundation would all adhere to GAAP principles but have their own unique set of accounting and financial reporting requirements.

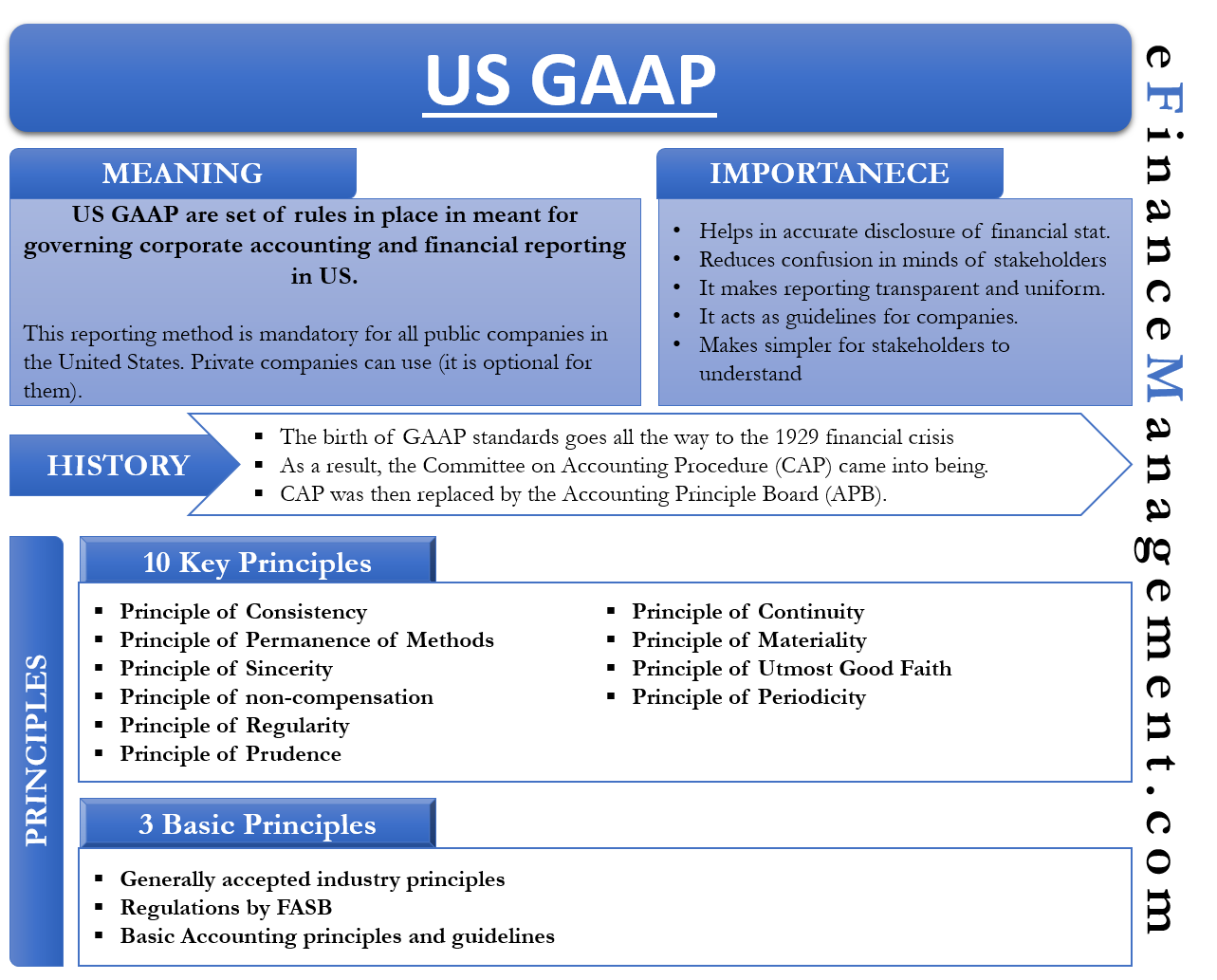

Ad Find Nonprofit Organisations. Generally accepted accounting principles US GAAP for non-profit organizations are. GAAP compliance allows not only donors but also creditors and other stakeholders to view financial data in a format that is consistent from organization to organization.

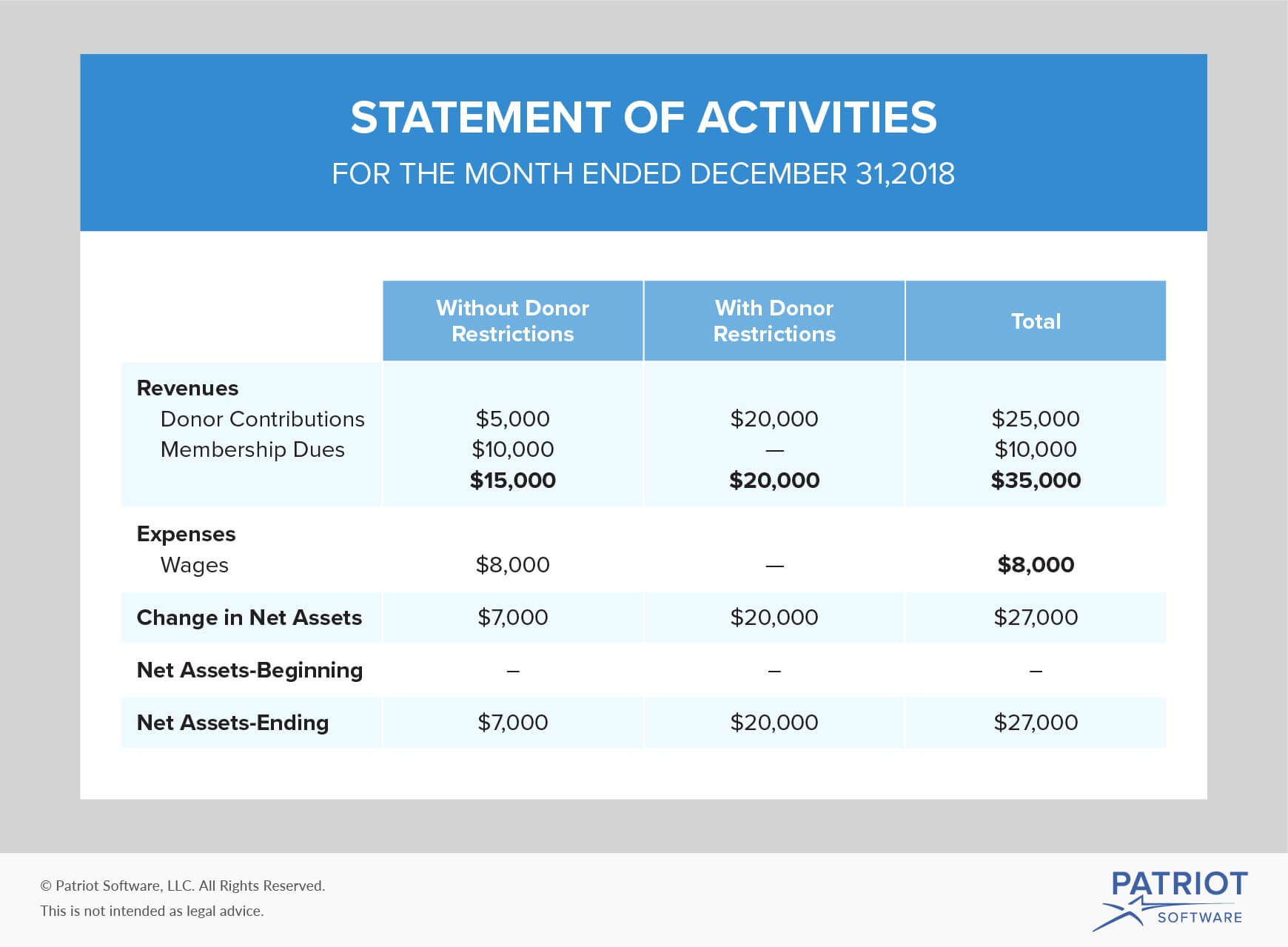

The principal financial statements required by US. The challenge of interpreting and implementing the authoritative literature comprising nonprofit GAAP is greater today than at any time in recent history. In the nonprofit accounting world an extended period of minimal changes is giving way to a succession of new rules and requirements that will govern nonprofit accounting for years to come.

The format of our Guide allows you to locate answers quickly and easily. FASB GAAP Update for Nonprofit Organizations August 16 2017 Accounting rules never stand still. When it comes to GAAP Expense Rules there are three things nonprofit organizations should be.

Most profit and nonprofit organizations comply with GAAP. There are certain pronouncements that apply only to non-profits and certain that do not apply to non-profits. For the latter doing so reassures a nonprofits stakeholders that the organizations financial reports accurately reflect its financial position.

How your organization must track and record in-kind donations depends on a few factors. Statement of functional expenses for some organizations Notes to financial statements. Not-for-profit organizations often find that there are many advantages to using GAAPespecially those seeking to expand their capacity to provide services.