Outrageous Reporting For Discontinued Operations Includes

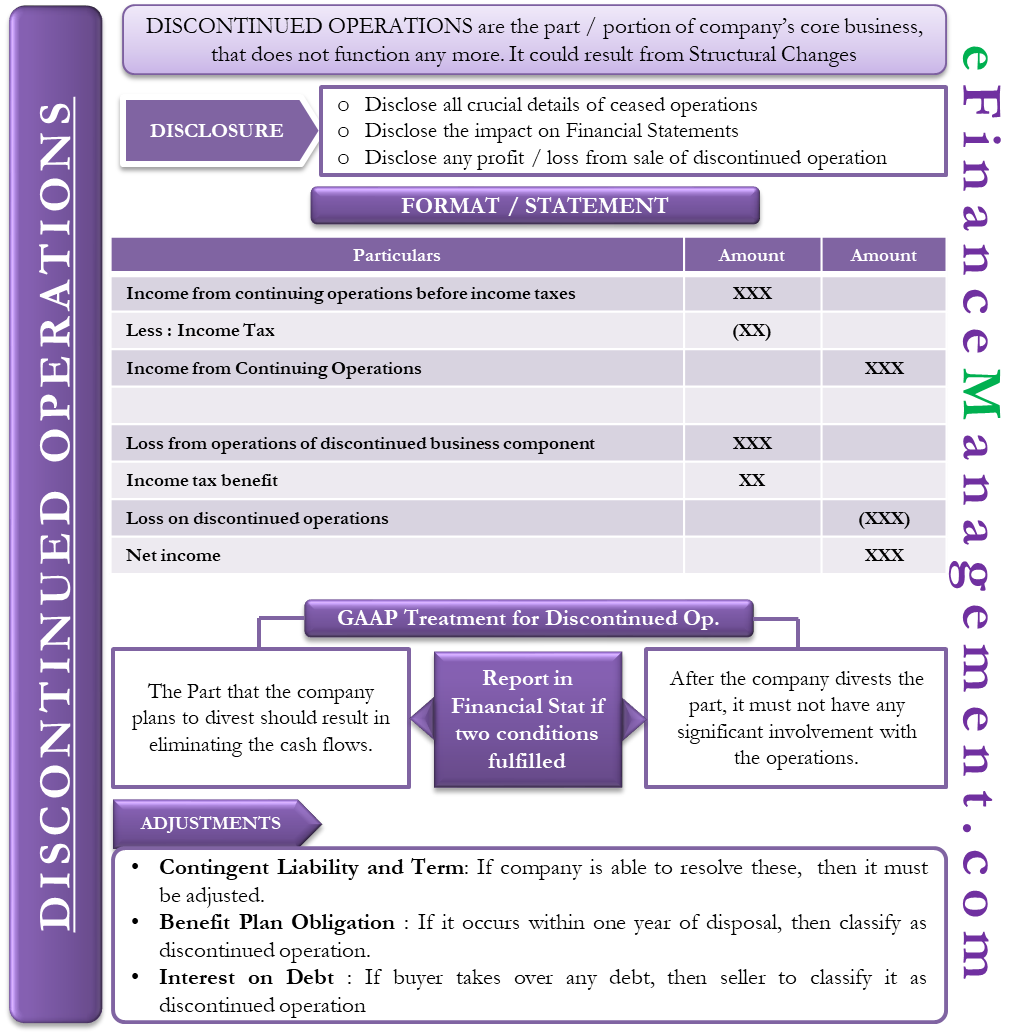

Discontinued Operations under IFRS Under the International Financial Reporting Standards IFRS discontinued operations are reported when they meet two criteria.

Reporting for discontinued operations includes. 75 Impact of Reporting a Discontinued Operation on Financial Information About Other Entities 59 751 Regulation S-X Rule 3-05. A disposal of a component of an entity or a group of components of an entity is. O The operations and cash flows have been or will be eliminated from the ongoing operations as a result of the disposal transaction o The entity will not have any significant continuing involvement in the operations after the disposal transaction.

This line includes also the impact of the measurement to fair value less costs to sell or of the disposal of the assetsdisposal group constituting the discontinued operation IFRS 533a. Financial Statements of Businesses Acquired or to Be Acquired 59 752 Regulation S-X Rules 3-09 and 4-08g. Discontinued operations are the results of operations of a component of an entity that is either being held for sale or which has already been disposed of.

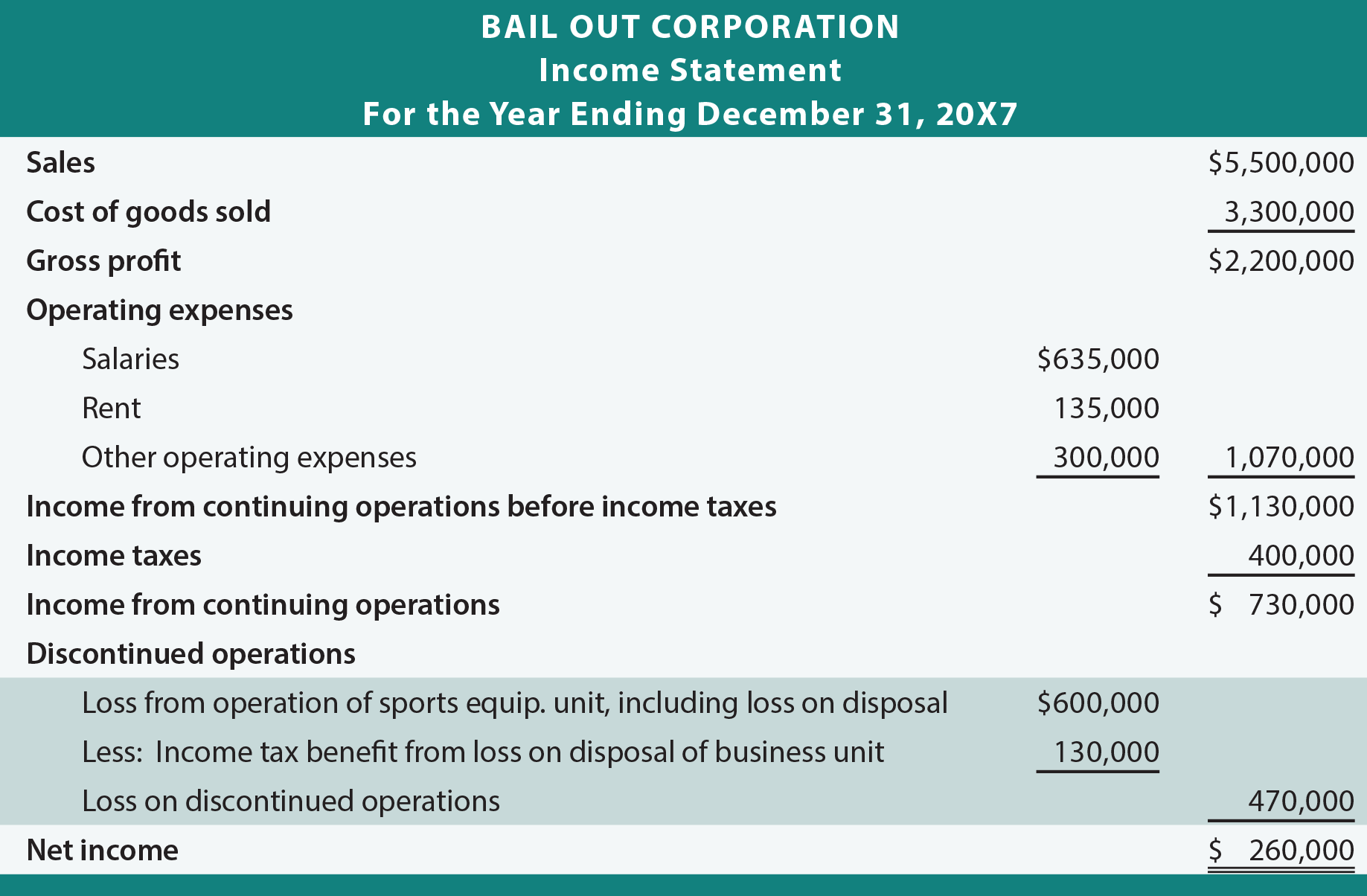

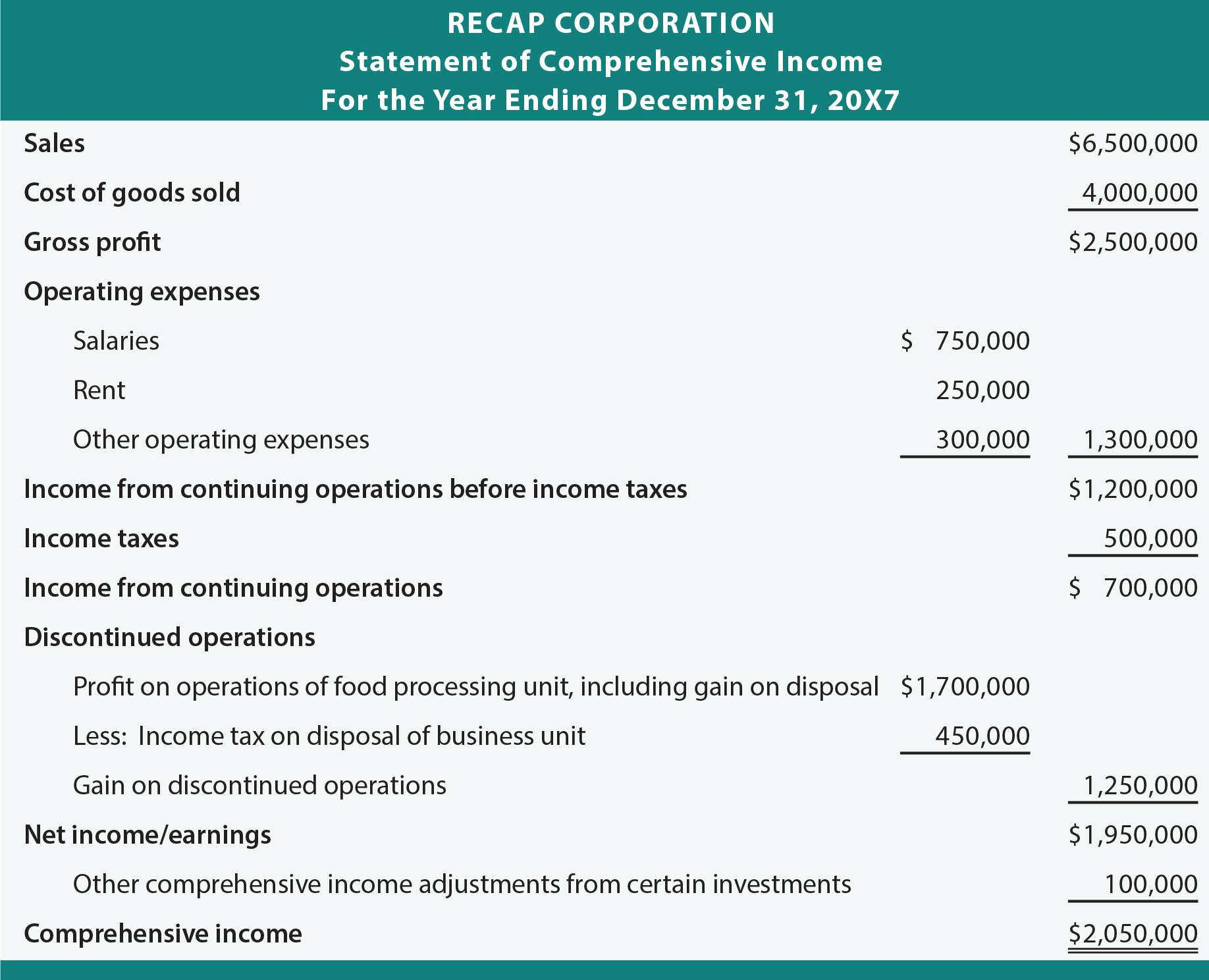

Loss on discontinued operations B. Is part of a single co-ordinated plan to dispose of a separate major line of business or geographical area of. Income or loss from operating the discontinued segment net of tax C.

The two components of this disclosure are the profit or loss from the discontinued operations and the gain or loss from disposal. On the income statement you should report the results of discontinued operations separately net of income tax from continuing operations. 31 2019 134000 Estimated operating losses Feb.

A discontinued operation may include a component of an entity or a group of components of an entity or a business or nonprofit activity. A discontinued operation is a component of an entity that either has been disposed of or is classified as held for sale and. 31 2019 21000 In its income statement for the year ended January 31 2019 Rocket would report a before-tax loss on discontinued operations of.

Income or loss from operating the discontinued operations net of tax and gain or loss from disposal of the operations net assets net of tax d. IFRS 532 represents either a separate major line of business or a geographical area of operations. They must include a discontinued operation separately in the asset and liability sections of the balance sheet.

:max_bytes(150000):strip_icc()/liabilities_-_resized-5bfc371146e0fb0051c0a014.jpg)

:max_bytes(150000):strip_icc()/accountingcalculating-5bfc32d246e0fb00517d4496.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1153850516-c94af82d74404d5a8d458a9fcb34bc50.jpg)