Nice Properly Classified Statement Of Financial Position

/ExxonLongtermAssets2018-5c5485414cedfd0001efdb2c.jpg)

Total assets Total liabilities Shareholders Equity.

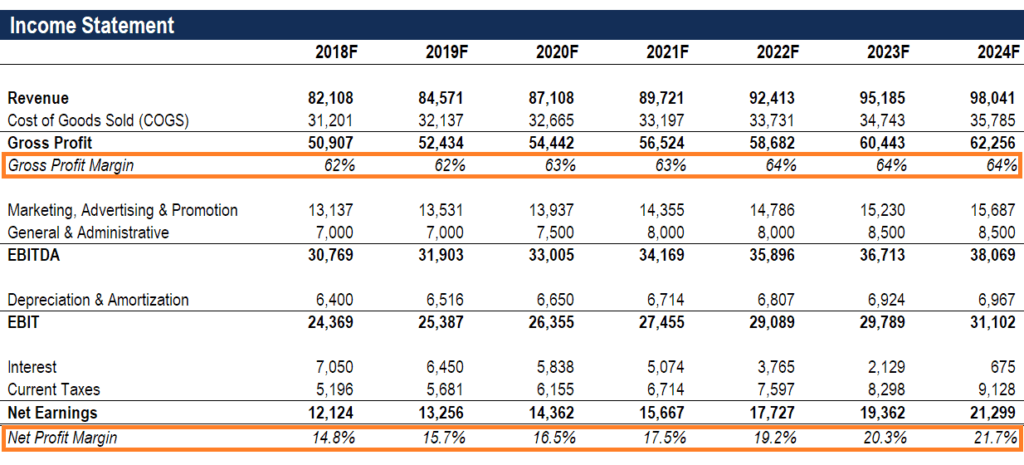

Properly classified statement of financial position. Under IFRS which of the following selections properly refer to what GAAP signifies as a balance sheet. The statement of financial position can be reported in either of the following formats. It is one of the financial statements and so is commonly presented alongside the income statement and statement of cash flows.

It is comprised of three main components. Businesses generally may be organized as sole proprietorships partnerships or corporations. The most common classifications used within a classified balance sheet are as follows.

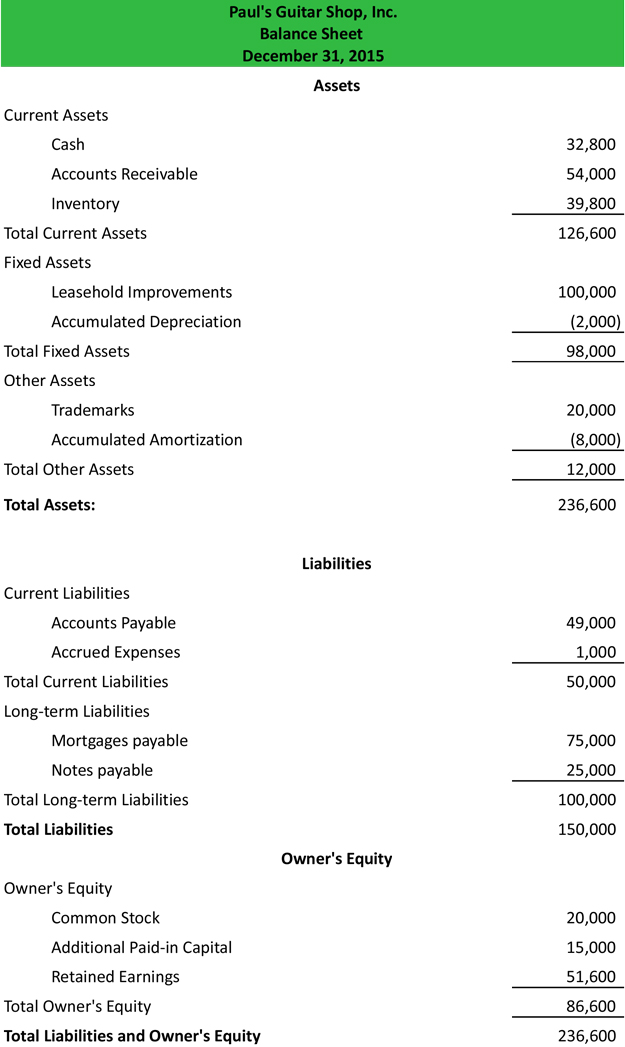

The appropriate financial statement presentation for equity depends on the nature of the business organization for which it is prepared. A classified balance sheet is a financial statement with classifications like current assets and liabilities long-term liabilities and other things. The balance sheet or the statement of financial position is one of the major components of financial statements which include the income statement statement of cash flow statement of changes in equity and the notes to financial statements.

Assets liabilities and equity. The illustrations in this book generally assume that. Inventories are properly classified in the statement of financial position as current assets.

Use the data provided below prepare a properly classified Statement of Financial Position using account form. Statement of Financial Position also known as the Balance sheet gives the understanding to its users about the financial status of the business at the particular point of time by showing the details of the assets of the company along with its liabilities and owners capital. Statement of financial wherewithal.

Fixed assets or Property Plant and Equipment The sum of these classifications must match this formula known as the accounting equation. The information on the statement of financial position can be used for a number of financial analyses such as comparing debt to equity or comparing current assets to current liabilities. Accrual accounting therefore gives the company a means of tracking its financial position more accurately.

/dotdash_Final_Capital_Expenditures_vs_Revenue_Expenditures_Whats_the_Difference_2020-01-160a38c63f364966bfc46acc4b6b2917.jpg)