Ideal Industry Benchmarks And Financial Ratios

1 Deep financials of each of the leading firms in the Subject Companys primary industry.

Industry benchmarks and financial ratios. Industry Market Analysis Industry analysis for 9000 lines of business. With BizMiner in hand our clients have a powerful tool. Comprehensive benchmarks for.

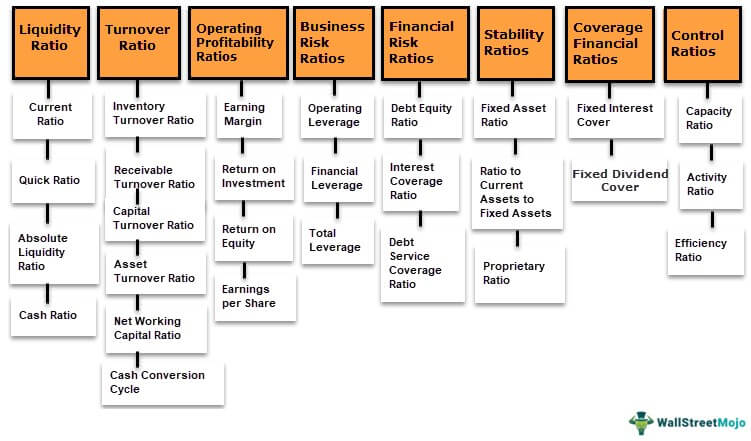

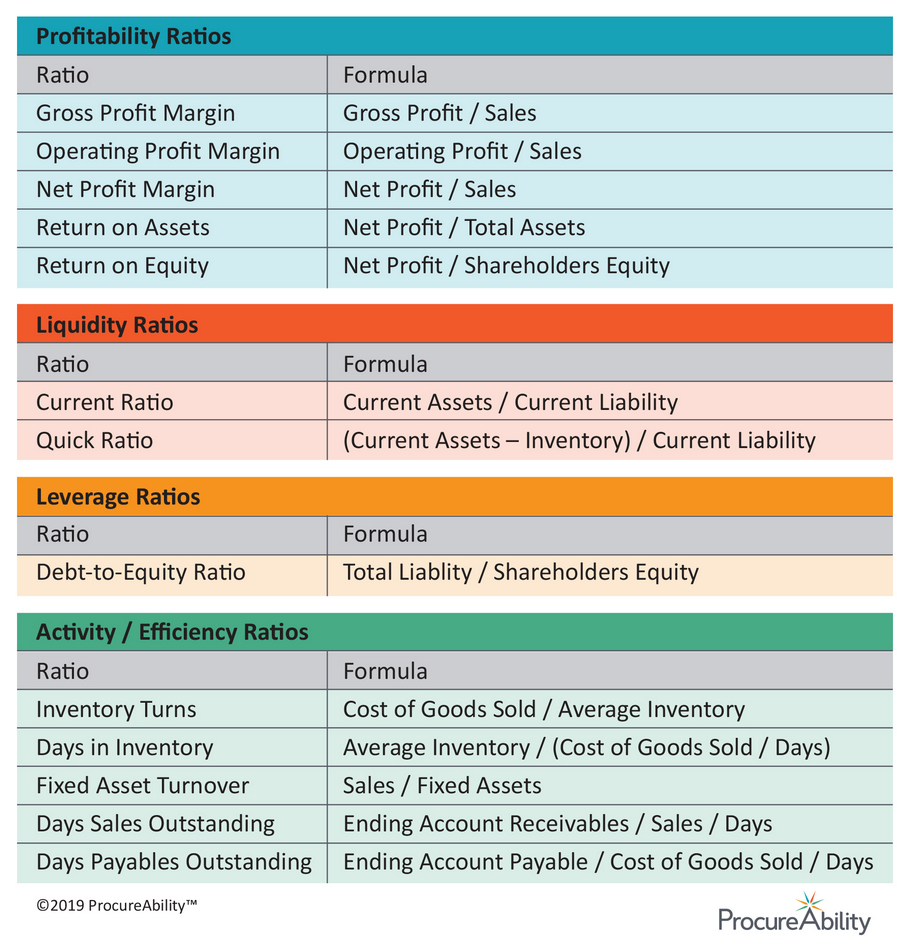

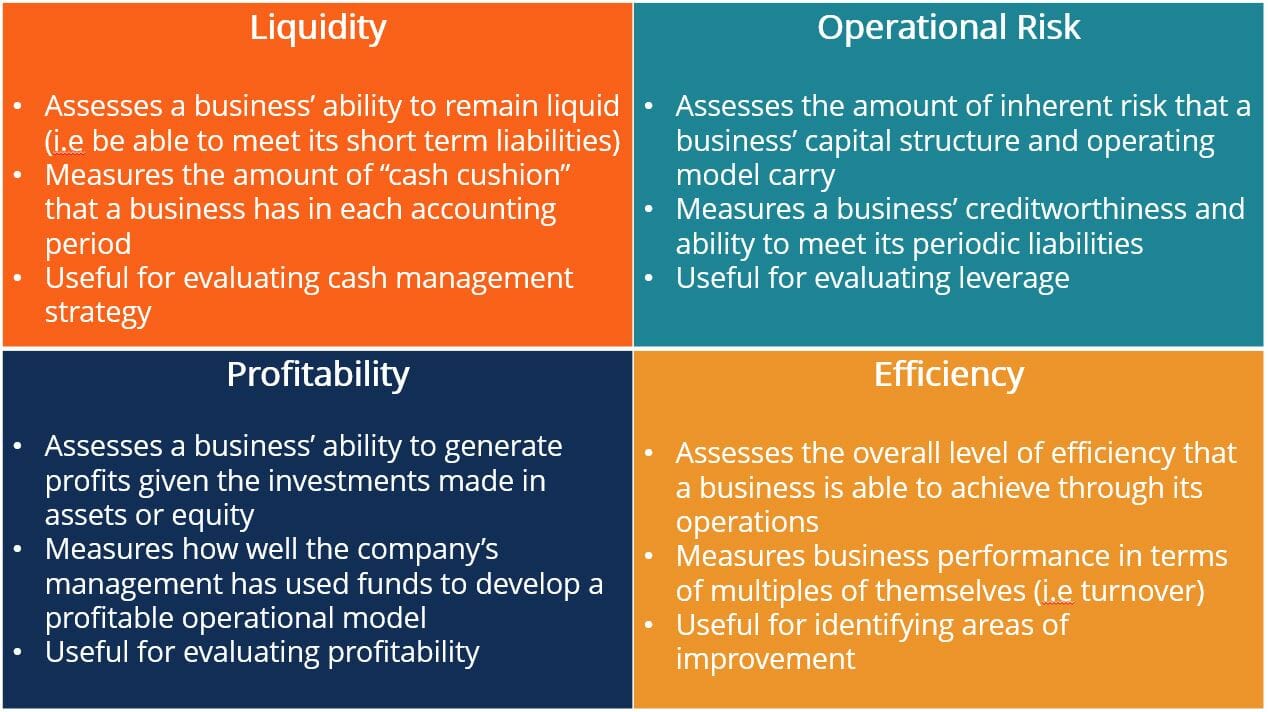

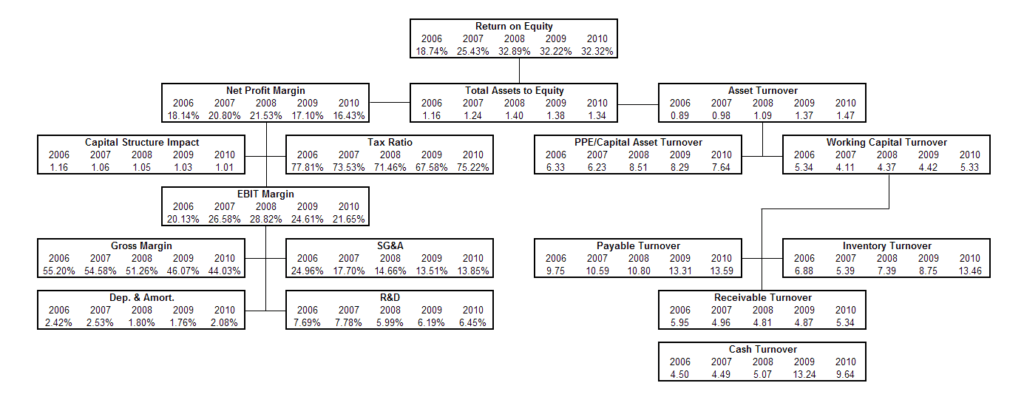

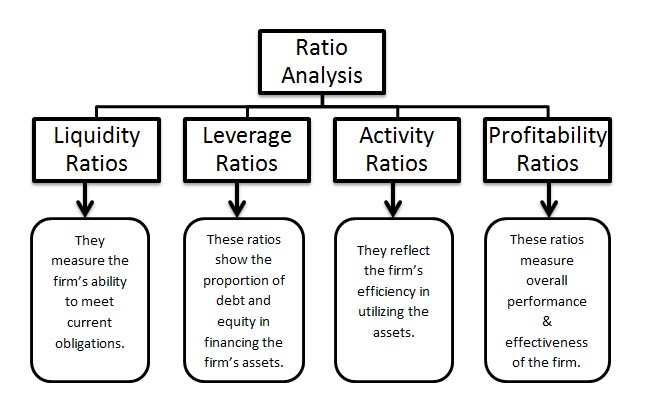

Financial ratios are a great way to analyze a business and far better than actually looking at raw numbers. However much depends on the standards of the specific industry you are reviewing. Ratios vary from industry to industry.

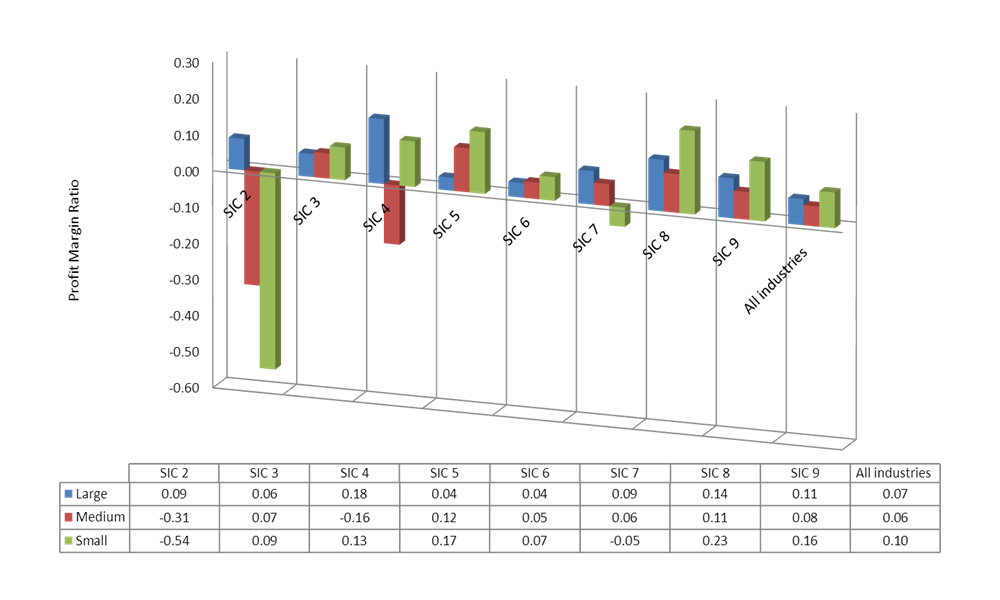

IBISWorld clients may have access to industry financial ratios that can be used to benchmark companies against an industry average. 220 rows Common Industry Benchmark databases for Financial Ratios The Risk. 22 rows Industry financial ratios are essential for comparative financial analysis.

If a companys inventory is slow in selling a stronger current ratio is required. Benchmarking and financial ratio analysis are tools that help you assess how your business is doing allowing you to make informed decisions to either get your company back on track or to maintain your current success. The online version of the RMA Annual Statement Studies includes financial ratio benchmarks as well as industry default probabilities and cash flow measures.

All Industries Measure of center. This Financial Analysis Benchmarks Report Was Published on and Includes. Industry ratios and financial benchmarks can be used to guage the market performance of companies.

Our US industry reports feature all the ratios mentioned above and more such as assets and liabilities. The data comes from more than 260000 statements of public and private companies but the vast majority are from small to. Generally a ratio of 2 to 1 is considered a sign of good financial condition.