Smart Accrued Revenue Balance Sheet Schedule 3 Of Companies Act 2013 Balance Sheet

With the change right there and the Ind ASs now commenced in their entirety it is time to understand what the new financial statements under Ind.

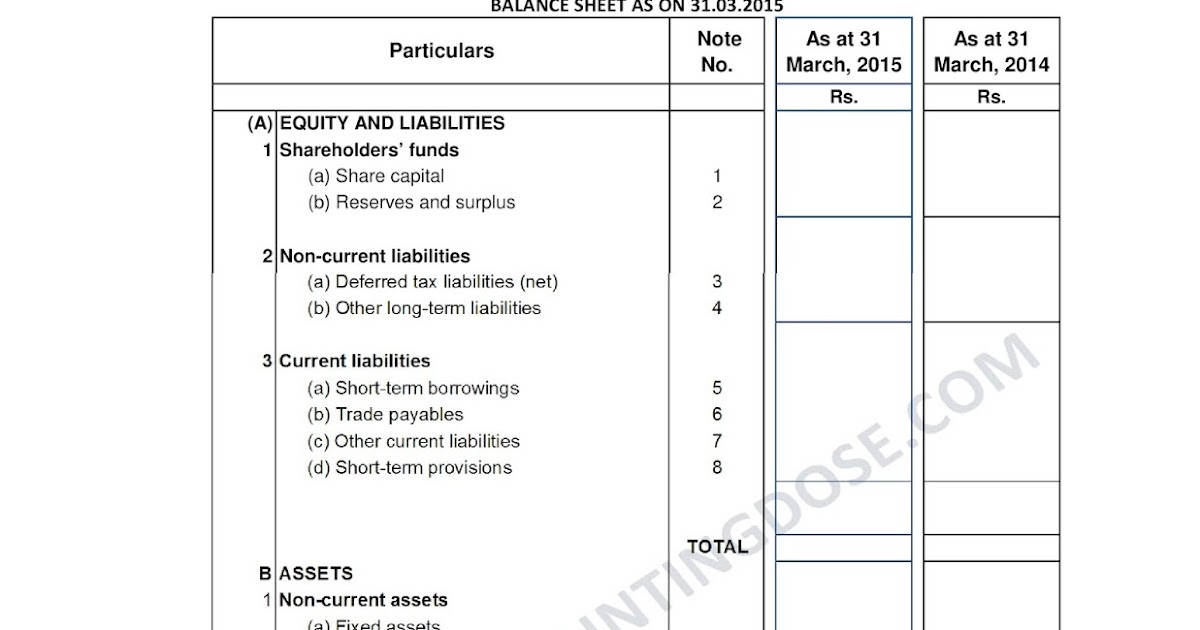

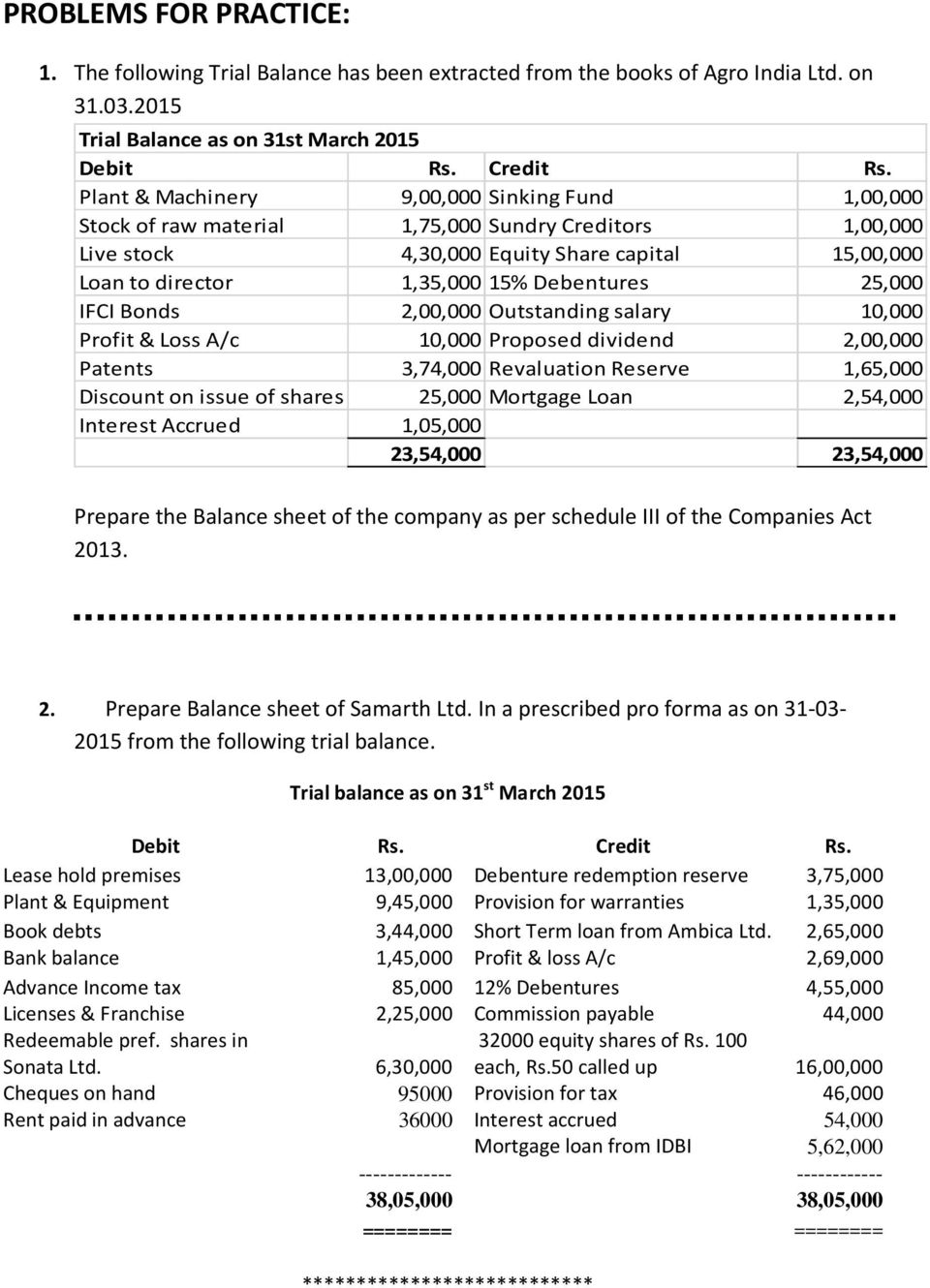

Accrued revenue balance sheet schedule 3 of companies act 2013 balance sheet. The following shall be substituted namely. 1 Subject to the provisions of this Schedule. LTD prepare a Balance Sheet of the company as on 31 st March 2015 as per Schedule III of the Companies Act 2013.

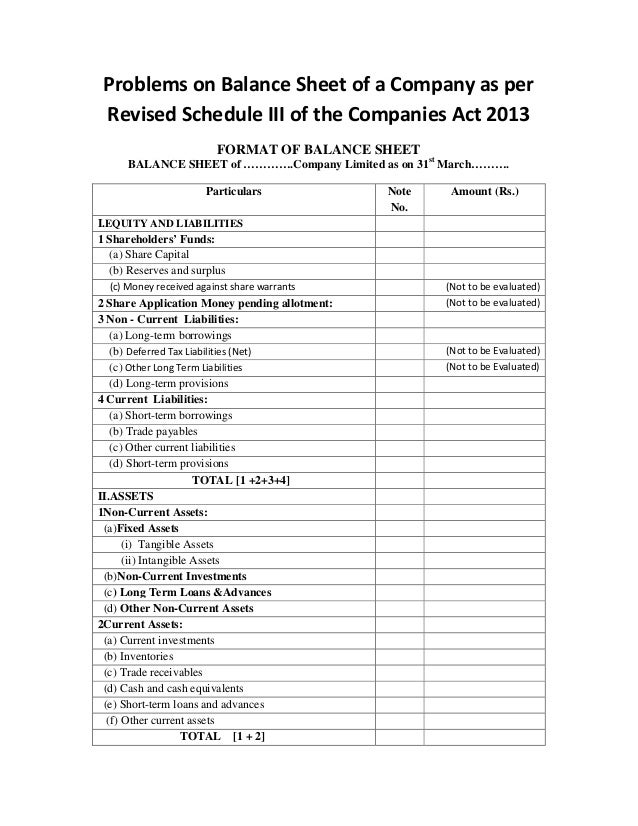

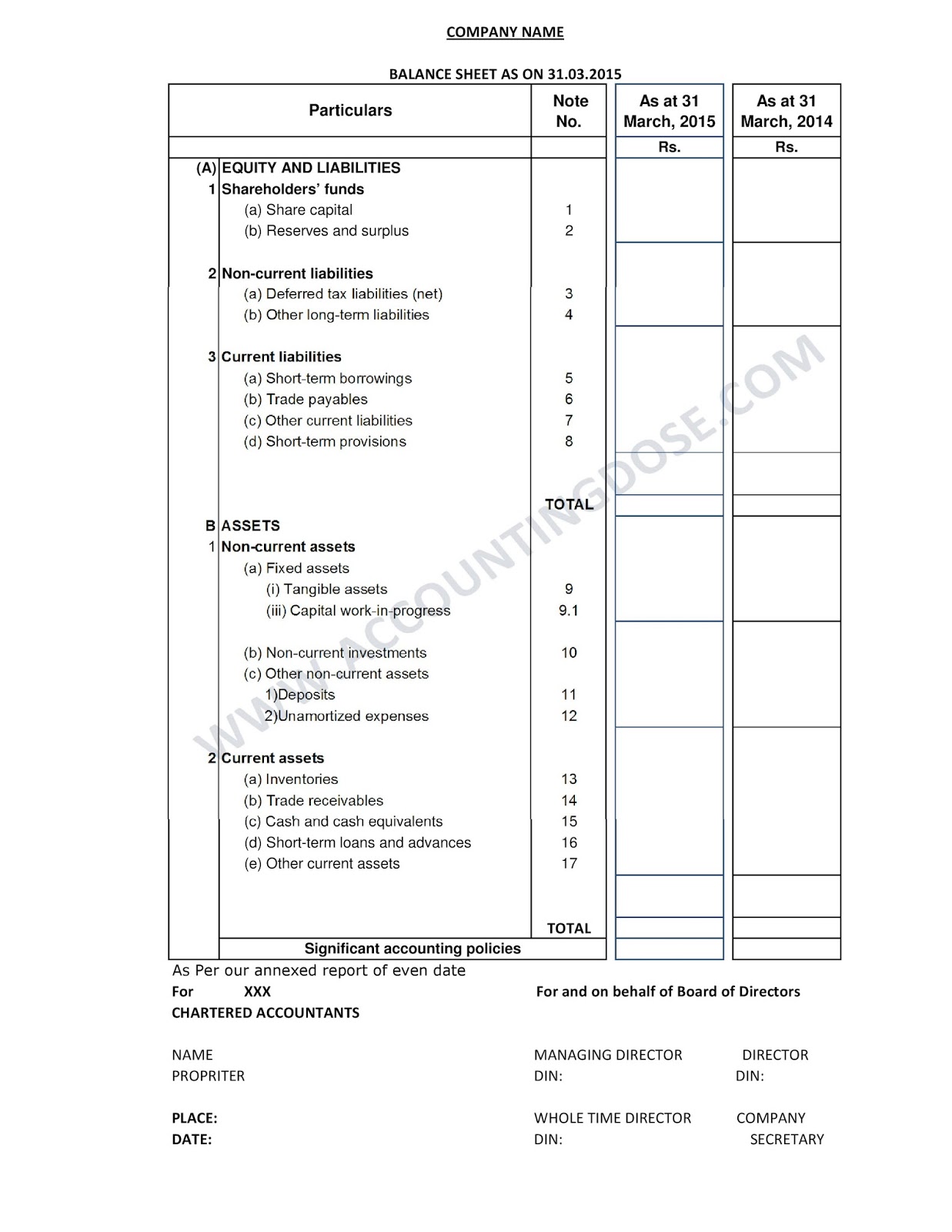

A Name the sub-heads under the head Current Liabilities in the Equity and Liabilities part of the Balance Sheet as per Schedule III of the Companies Act 2013. ACCOUNTING PRINCIPLES FORM AND CONTENT OF ENTITY FINANCIAL STATEMENTS. 1 Without prejudice to the generality of section 9 of the Interpretation Act 2005 and its application to the body of this Act and to Schedules 1 2 and 5 to 17.

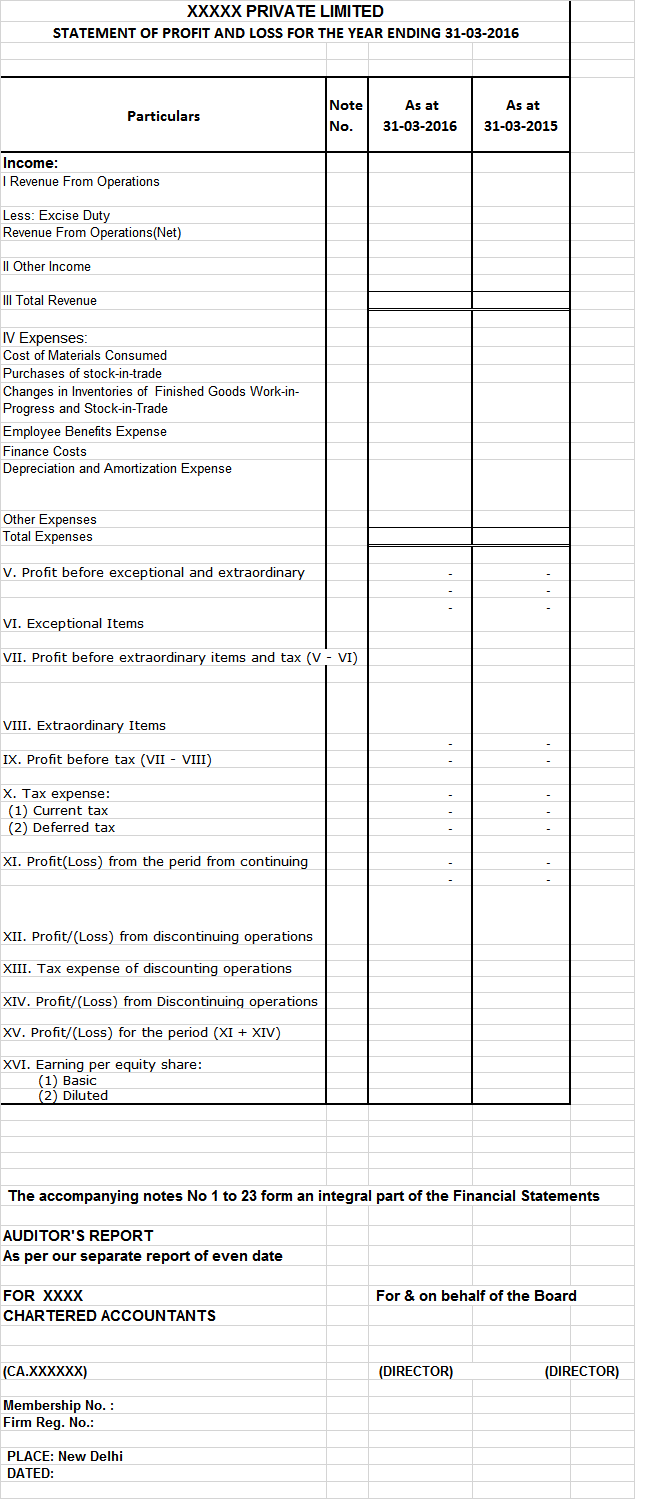

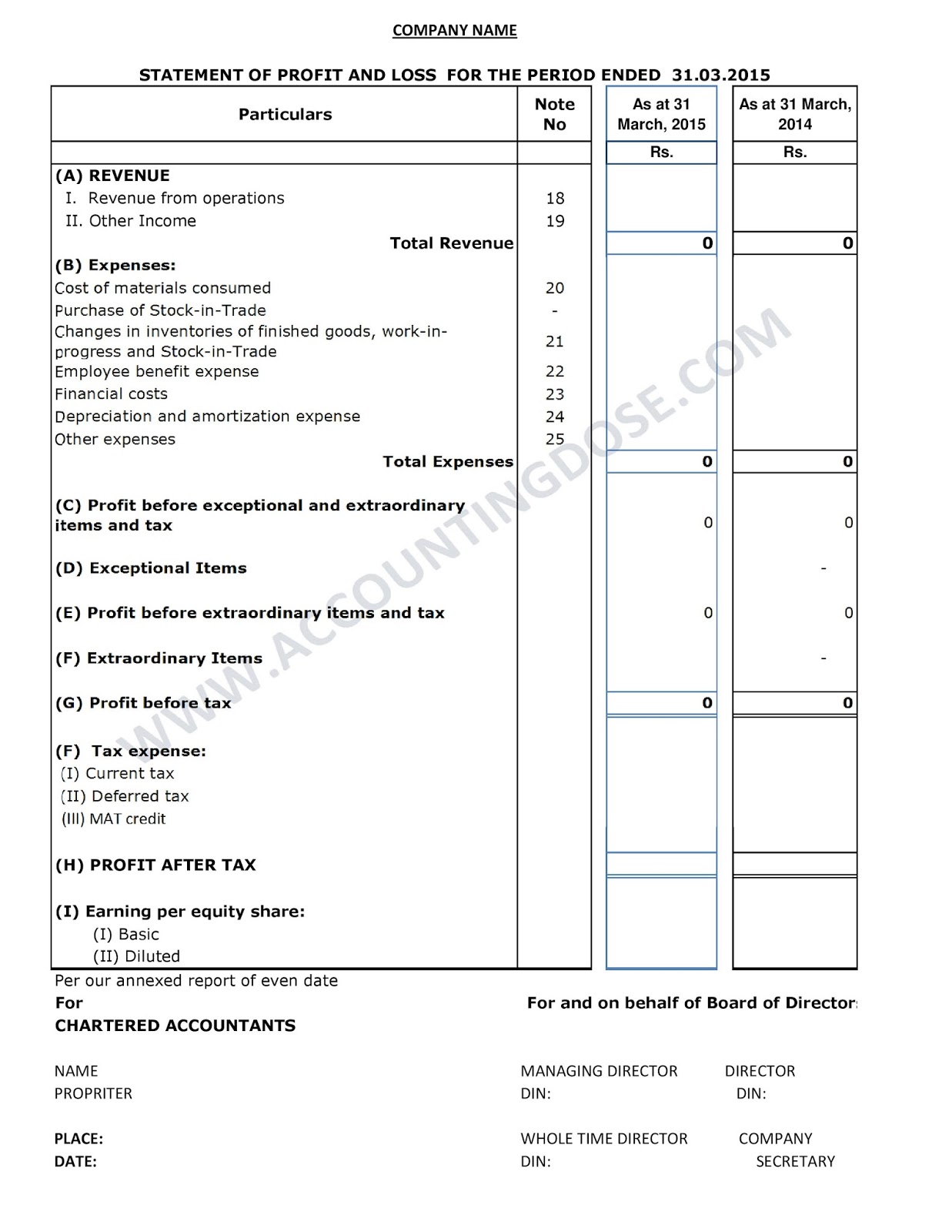

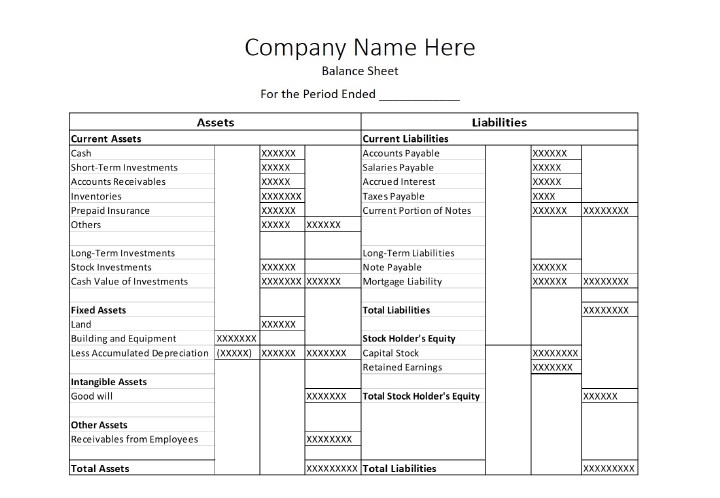

It is a statement of assets liabilities and equities of a business and it is prepared to show the financial position of the company at particular date. B every profit and loss account of a company shall show the items listed in the profit and loss accounts format so set out. Schedule III See section 129GENERAL INSTRUCTIONS FOR PREPARATION OF BALANCE SHEET AND STATEMENT OF PROFIT AND LOSS OF A COMPANY.

From the following Ledger balances of PREMIER CO. 2354000 Prepare the Balance sheet. Unpaid dividends Interest accrued and due or not due on borrowings Income received in advance Calls in advance os Interest on calls in advance.

Schedule III -Format Of Balance Sheet -Format Of The Profit And Loss Account COMPANIES ACT 2013 By CA Piyali Parashari CA CWA B Com Hons 2. Schedule III of Companies Act 2013 India. Schedule III of the 2013 Act deals with instructions for prepation of Balance Sheet and Profit and Loss of account of a company under section 129 of the 2013 act.

Where compliance with the requirements of the Act including Accounting Standards as applicable to the companies require any change in treatment. What are provisions relating to financial statements under the New companies act 2013. Where compliance with the requirements of the Act including Accounting Standards as applicable to the companies require any change in treatment or disclosure including addition amendment substitution or deletion in the head or sub.