Cool Prepare Financial Reports Deferred Tax Liability Calculation Example

A deferred tax is the difference between net income and income before taxes.

Prepare financial reports deferred tax liability calculation example. Follow these steps to calculate the deferred tax assetliability. For example if a company has an asset worth 10000 with a useful life of 10 years. 250000 and depreciation charged as per IT act is Rs.

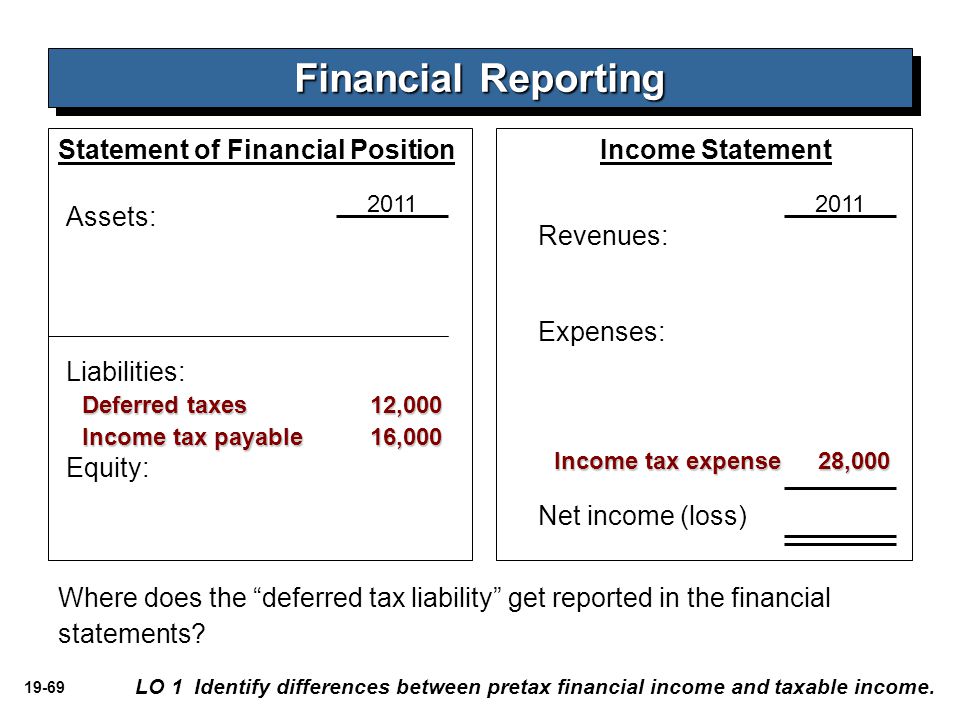

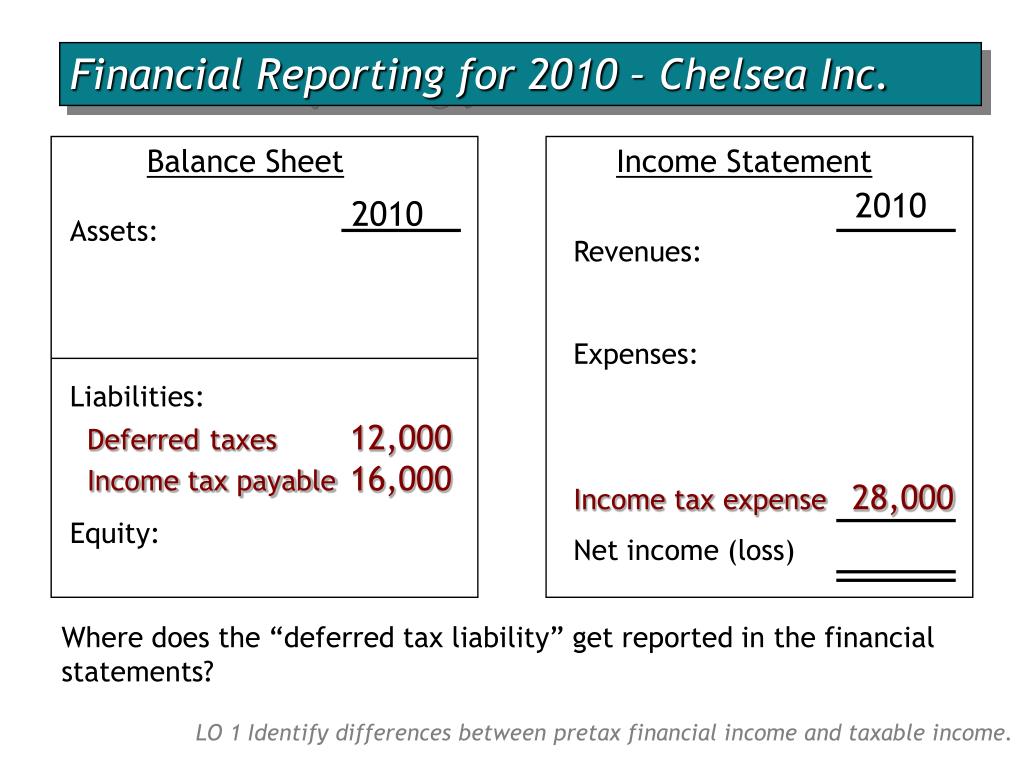

Before understanding deferred tax liability it is essential to note that companies that incur such an obligation prepare and maintain two financial reports every year tax statement and income statementThe latter primarily includes Profit Loss Account. The sections of the guide are as follows. The balance on the deferred tax liability account is 150 representing the future liability of the business to pay tax on the income for the period.

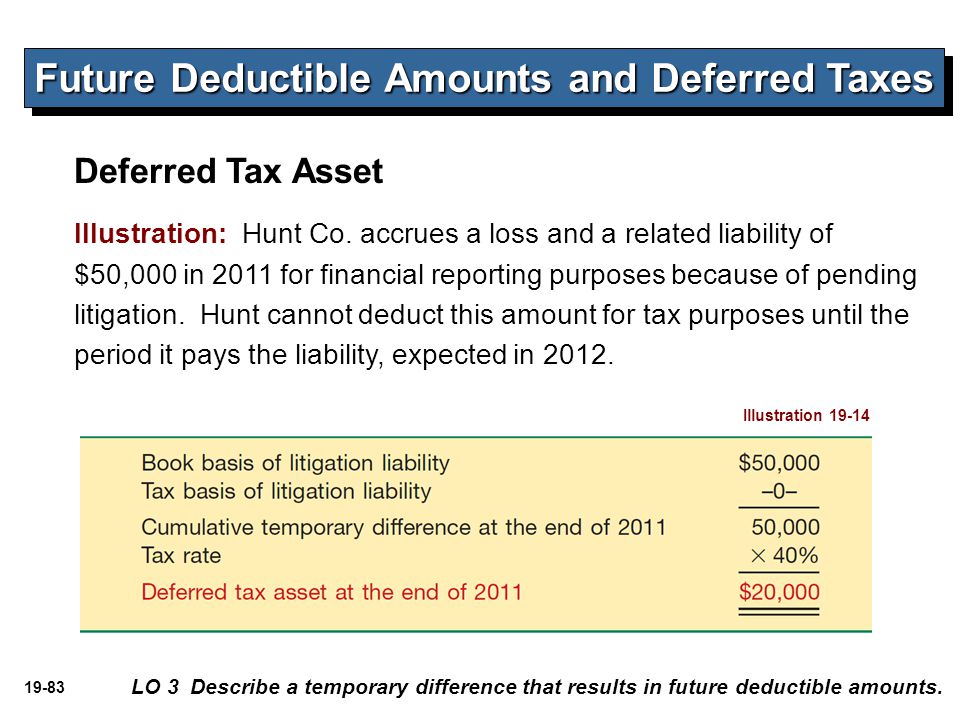

One of the key causes for preparing two statements to express similar financial events is the. Calculating a deferred tax balance the basics IAS 12 requires a mechanistic approach to the calculation of deferred tax. Deferred tax liability can be defined as an income tax liability to the IRS for having tax payable less than what you actually incurred due to temporary differences between accounting income and taxable income.

Deferred tax assets and liabilities exist because the income on the tax return is different than income in the accounting records income per book. Identify any assets and liability that have a different tax basis from its book value in the financial statements. Deferred tax liability or deferred tax asset forms an important part of the year-end financial closure as it has an impact on the tax outflow of the company.

The purpose is to analyze the extent to which the disclosure relating to the Australian accounting standard has prescribed and second. The income tax payable account has a balance of 1850 representing the current tax payable to the tax authorities. If depreciation charged for the year as per companies act is Rs.

One common cause of deferred tax liability is if a company uses accelerating depreciation for tax calculation and the straight-line method for accounting purpose. What is a Deferred Tax Liability. Definition Example And Calculation.