Outrageous Fair Value Through Profit And Loss Ifrs 9

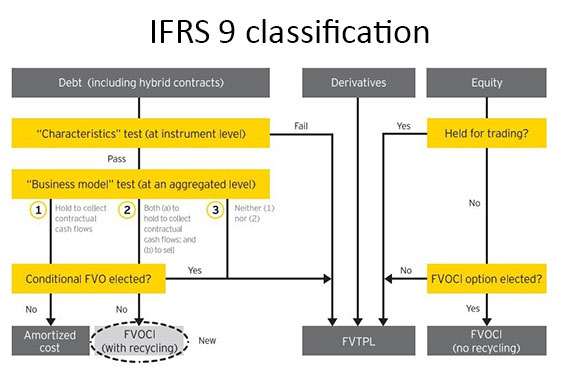

IFRS 9 classifies financial liabilities into 2 categories.

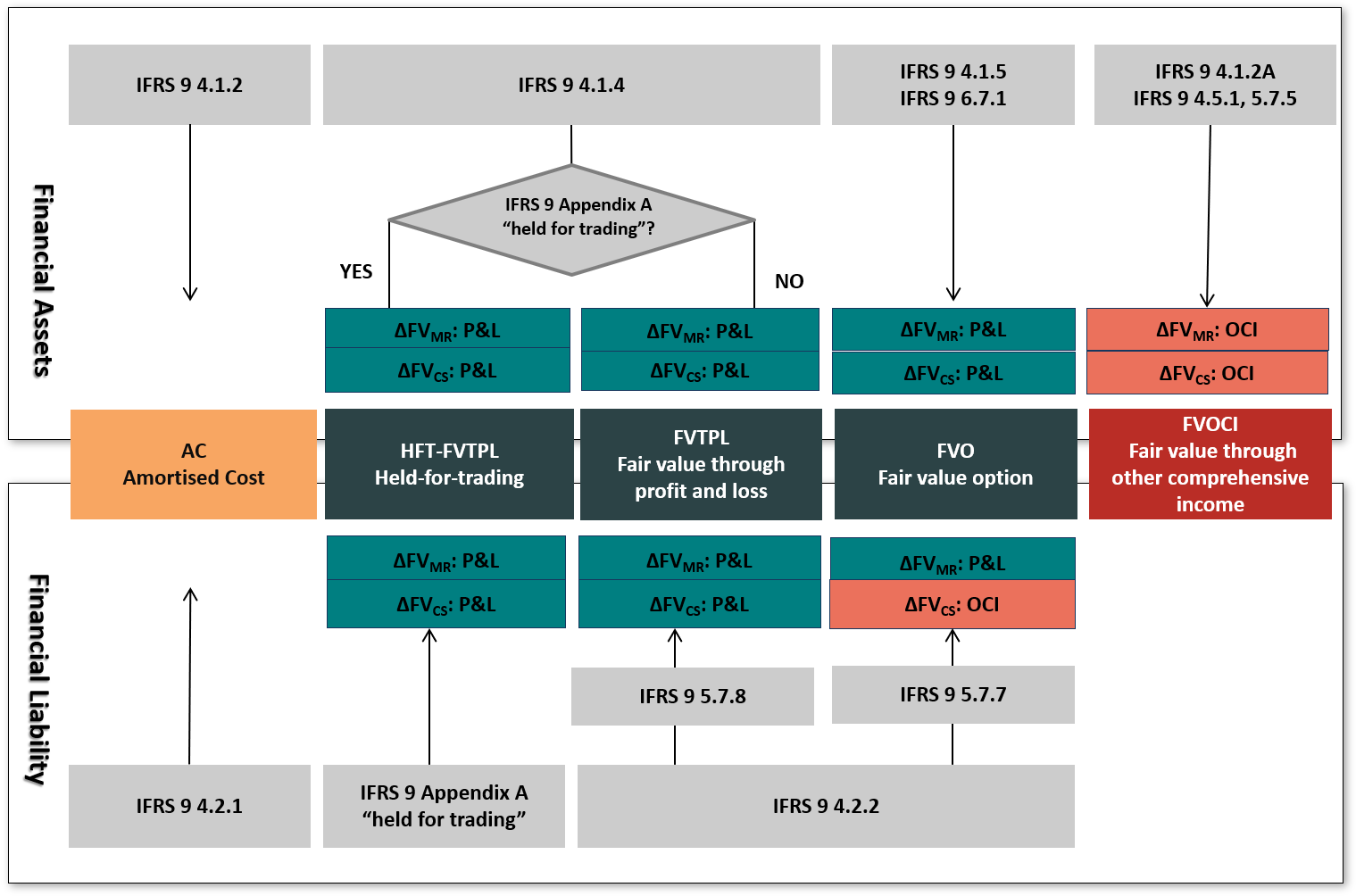

Fair value through profit and loss ifrs 9. An entity has a financial liability designated at fair value through profit or loss. Financial assets under IFRS 9 will be classified into one of three main classification categories ie. Loans and receivables including short-term trade receivables.

When and only when an entity changes its business model for managing financial assets it must reclassify all affected financial assets. In this Viewpoint we explore the acceptable methods of. Financial liabilities measured at fair value through profit or loss FVTPL distinguishing between those designated into that category and those meeting the definition of held for trading.

This requirement is consistent with IAS 39. Additionally the Group applies the fair value option for its third-party executory forward purchase and sales contracts available under IFRS 9 as an alternative to the. Financial liabilities at fair value through profit or loss.

Financial liabilities at fair value through profit or loss Financial liabilities at amortised cost. Journal Entries for Financial Assets and Financial Liabilities held at Fair Value Through Profit or Loss FVTPL under IFRS 9 May 4 2020 IFRS 9 requires changes in fair value on financial liabilities designated as at FVTPL to be split into. As I know the accounting is mainly emphasizing on the on-balance-sheet part which is the fair value gain or loss by IFRS 9.

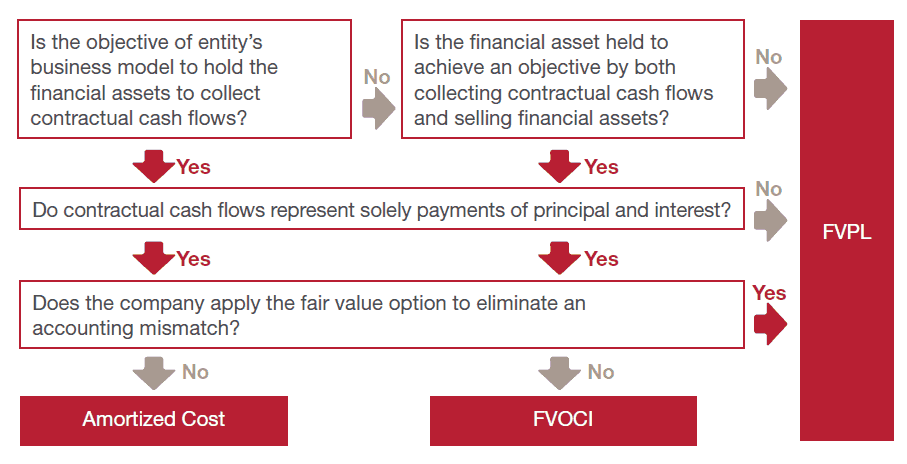

The fair value of the liability decreases by 10000 with 2000 of that decrease due to a change in the entitys own credit risk. Fit easily within IFRS financial reporting structure. Amortised cost fair value through other comprehensive income FVOCI and fair value through profit or loss FVPL.

And lease receivables that are within the scope of IAS 17 Leases and trade receivables or contract assets within the scope of IFRS 15 that give rise to. On the other hand IFRS 9 establishes a new approach for loans and receivables including trade receivablesan expected loss model that focuses on the. However under IFRS 9.