First Class Foreign Subsidiary Consolidation

IFRS 10 outlines the requirements for the preparation and presentation of consolidated financial statements requiring entities to consolidate entities it controls.

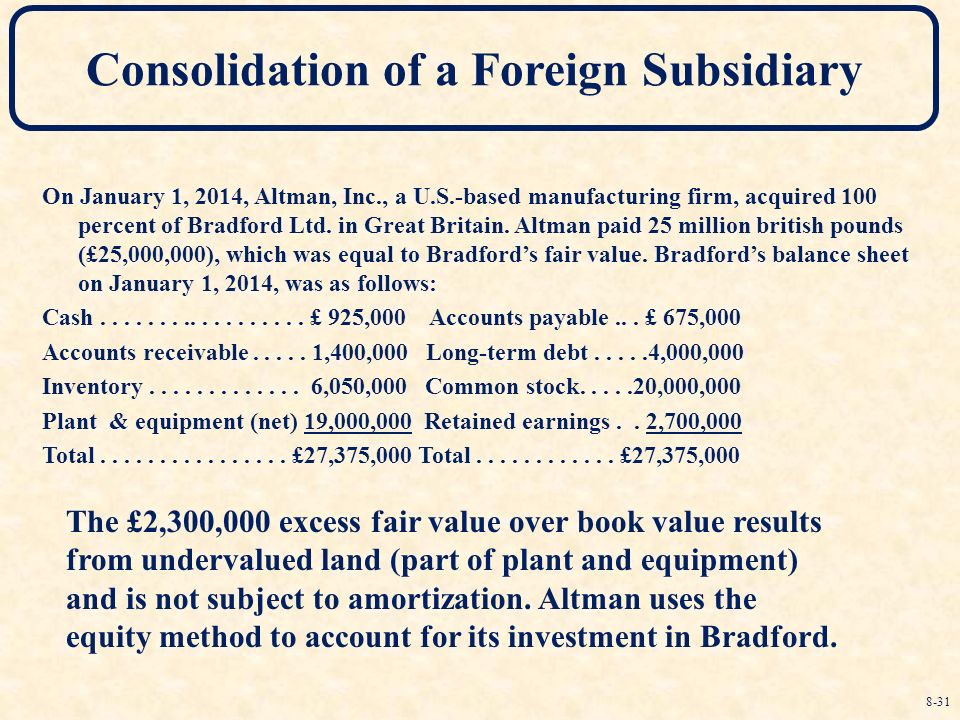

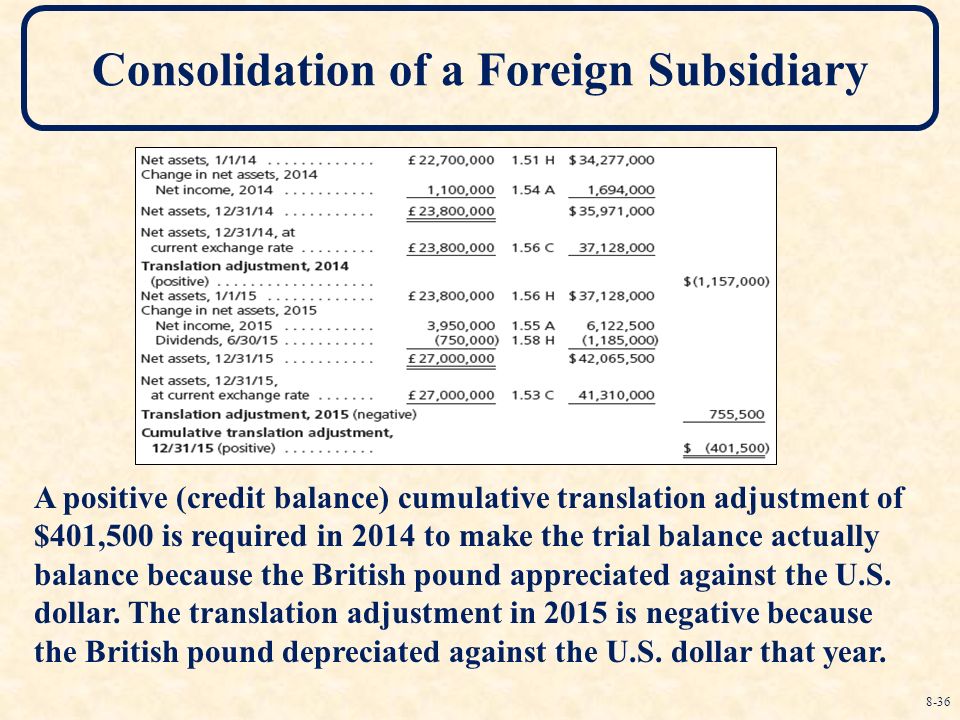

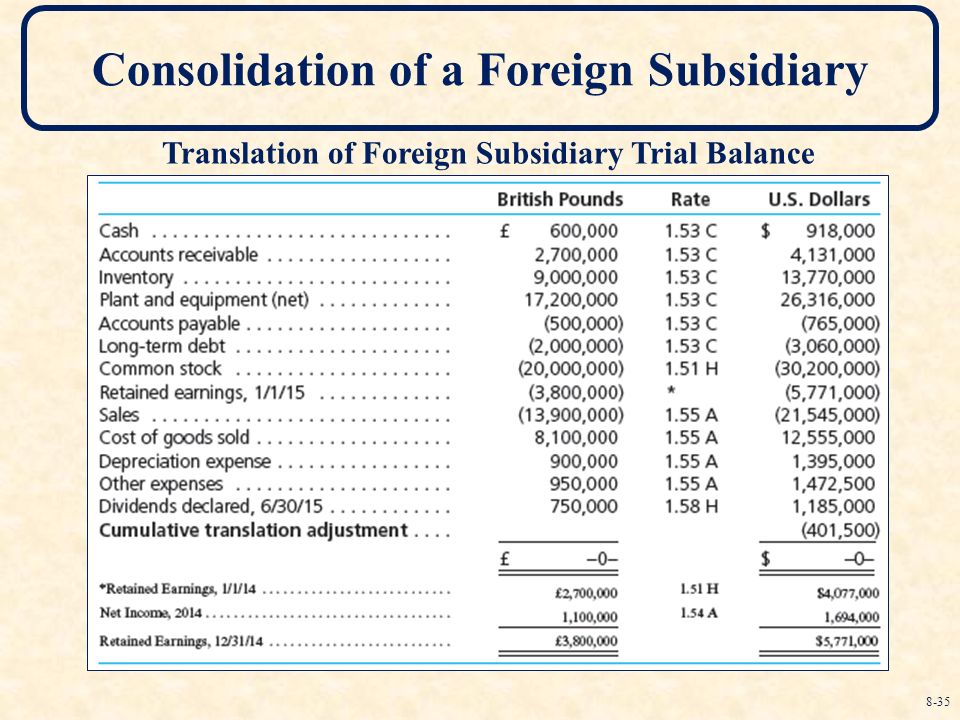

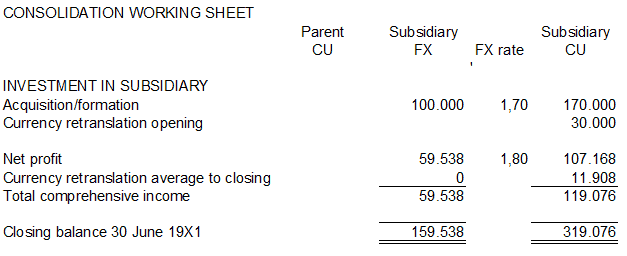

Foreign subsidiary consolidation. Ad Discover our software for your tax consolidation or account reconciliation. The term Foreign Consolidated Subsidiary captures any covered swap entity see below that is not a US person in which an ultimate parent entity that is a US person has a controlling interest in accordance with US GAAP such that the ultimate parent entity includes the non-US covered swap entitys operating results financial position and statement of cash flows in its consolidated financial statements in. The relevant requirements are included in IAS 21 The Effects of Changes in Foreign Exchange Rates.

IFRS 10 was issued in May 2011 and applies to annual periods beginning on or after 1 January 2013. Consolidation entries for subsidiary. Ad Expand Your Business to 187 Countries With Our Global Expansion Services.

The second category that is an autonomous subsidiary the consolidation rules relating the foreign exchange are significantly different. Skip the Hassle of Establishing an In-Country Subsidiary with Our EOR Model. It will apply when parent has more than 50 of share with voting right in the subsidiary.

The first category which is dependent sunbsidiary the consolidation process is rather straight forward. Second category is where the foreign subsidiary is independent in its operations and acts with autonomy. More recently on 16 January 2015 the MCA issued another amendment that provides that the requirements in respect of consolidation of financial statements shall not apply to a company having subsidiary or subsidiaries incorporated outside India only for the financial year commencing on or after 1 April 2014.

Functional currency is the currency of the primary economic environment in which the entity operates. Ad Expand Your Business to 187 Countries With Our Global Expansion Services. Skip the Hassle of Establishing an In-Country Subsidiary with Our EOR Model.

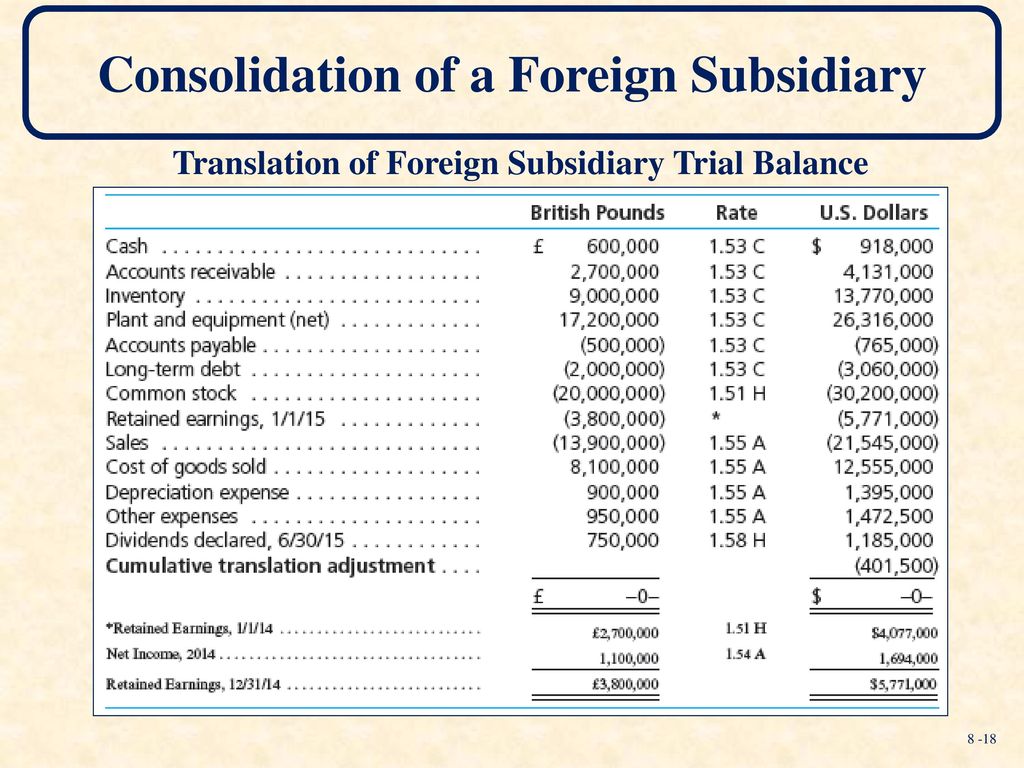

This is a key part of the financial statement consolidation process. Foreign currency translation is used to convert the results of a parent company s foreign subsidiaries to its reporting currency. Ad Discover our software for your tax consolidation or account reconciliation.

/dotdash_Final_Subsidiary_Jul_2020-01-5cb00a7e65ed43618112f2f94829fc03.jpg)